The think-tank claims that eliminating three important inheritance tax reliefs would create a fairer system and bring in £3 billion for the Treasury in the current tax year.

In a recent report, the Institute for Fiscal Studies (IFS) projected that the UK could obtain an additional £2.7 billion in proceeds in fiscal year 2024–2025 by removing preferential treatments for shares on Aim, limiting business and agricultural reliefs, and taxing defined contribution pension pots.

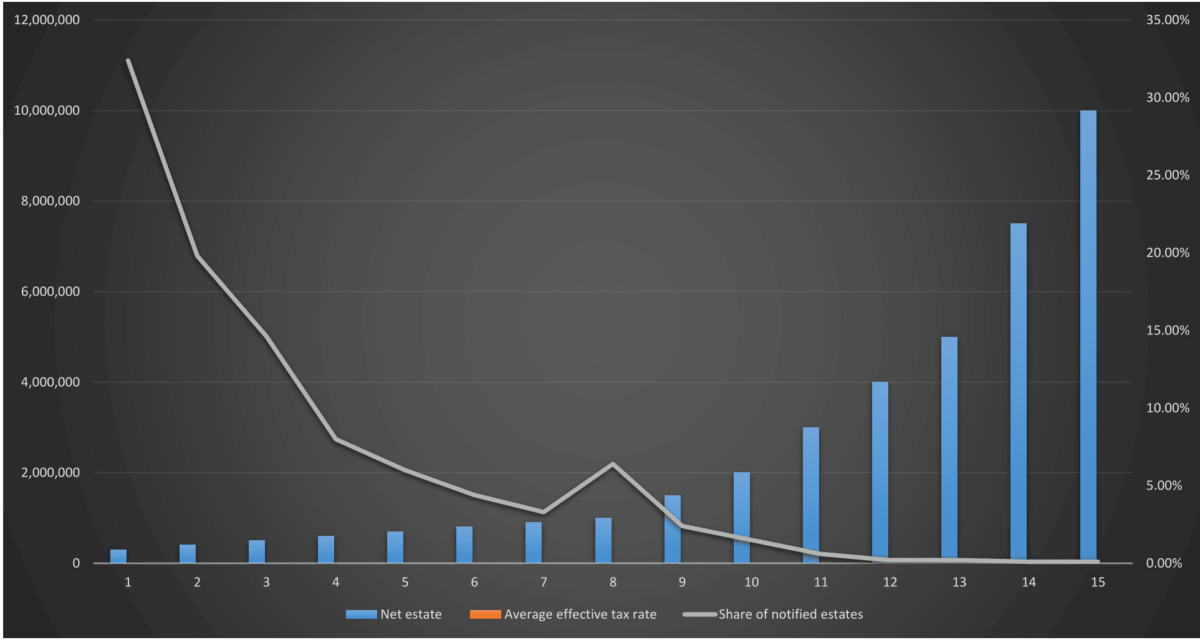

According to the IFS report, UK Inheritance Tax (IHT) includes a long list of exemptions. Last year, IHT generated £7 billion. It calculated that the cost of exempting business assets, agricultural property, gifts to charity and houses up to a certain value from IHT was around £4.2 billion.

In order to address the disproportionately high effective tax rate of 17% for estates valued at £10 million or more compared to the overall tax rate of 40%, the IFS proposes that agricultural and business reliefs should be capped at £500,000 per person to allow property transfers of up to £1 million.

Furthermore, they propose that unused allowances should be left to surviving spouses or partners and support the removal of these allowances to amend inheritance tax laws.

Impact of the Proposed Inheritance Tax Changes

Chancellor Jeremy Hunt has reportedly been considering scrapping inheritance tax. However, at the last Budget he introduced new IHT relief which extends the types of land exempt from tax from next April.

In terms of UK tax law, Aim-quoted shares held for more than two years at the time of death can be transferred tax-free to heirs. IFS believes that these shares are prudent investments for older investors looking to reduce their tax liabilities.

Nevertheless, the research institute estimates that the removal of Aim relief could generate at least £1.1 billion in revenue this tax year, and up to £1.6 billion in 2029-2030. It added that these figures may underestimate the use of Aim relief by trusts that are not subject to direct reporting.

Closing the Pension Tax-Free Transfer Loophole

As the IFS report sees it, the final step is to close the tax-free transfer loophole for defined-contribution pensions. It finds no economic justification for the measure and believes that it allows unethical transfers of wealth. Eliminating this loophole could raise £200 million in the current tax year, a figure that could rise to £1-2 billion as the value of defined contribution pensions increases over time.

Mubin Haq, chief executive of the Abrdn Financial Fairness Trust, said that “the public perception of loopholes benefiting a small minority undermines support for tax”. “Reducing some of the key exemptions could lead to an increase of over 15% in Inheritance Tax receipts.