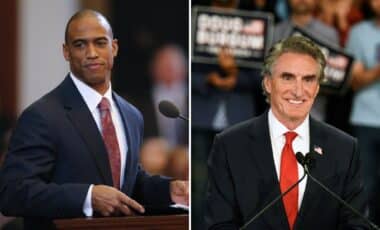

March 1 Deadline Could Save Homeowners Hundreds, But Time Is Running Out

Homeowners in Montana have only a few days left to secure a reduced property tax rate for 2026. Governor Greg Gianforte’s new initiative promises significant savings, but time is running…

Home Buyers Pull Back as US Sales Post Surprise Annual Slump

US home sales have recorded their steepest year-over-year decline in 12 months, signaling a marked winter slowdown. Contracts are falling, homes are sitting longer on the market, and buyers appear…

New Inflation Numbers Just Shifted the Housing Market Narrative

Fresh inflation data is drawing attention across the housing market. After months of stalled activity, new signals are emerging. Mortgage rates remain elevated, yet momentum may be shifting.

Why the U.S. Housing Market May Be Headed for a Major Breakdown

The U.S. housing market is facing unprecedented challenges, with experts warning a new crisis could be on the horizon. Falling sales, skyrocketing prices, and dwindling inventory are just some of…

Trump Unveils a Bold Strategy to Fix the Housing Crisis

Banning institutional investors and buying mortgage bonds may offer short-term relief, yet economists warn that deeper supply issues remain untouched. With housing affordability at a crisis point in the U.S.,…

$25,000 Home Equity Loan in 2026: How Much You’ll Actually Pay Each Month

Homeowners can expect monthly payments between $240 and $305, based on current interest rates and loan terms. These fixed-rate loans offer stability amid a shifting interest rate environment.

$500 Housing Stimulus: Find Out If You Qualify for the Stability Program

A privately funded initiative is delivering monthly payments to selected families in Indianapolis. The effort aims to support housing stability through guaranteed, no-strings-attached income.

New Housing Executive Order Could Change How You Buy a Home Forever

A sweeping executive order is being drafted to tackle the mounting crisis in housing affordability, with emphasis on first-time buyers. New proposals include 50-year mortgages, tax-free savings withdrawals, and a…

Half of Homeowners Are Ready to Flee Their Homes, Here’s Why

With climate change driving more frequent and severe weather events, nearly 50% of homeowners are seriously considering relocating to safer areas, fearing the long-term impact on their properties and lives.

Mortgage Rates Stuck at 6.2%: Here’s Why They Won’t Budge Anytime Soon

Mortgage rates are stuck at 6.2% and might not move much in 2026 as inflation and labor trends pull in opposite directions.

Rates Just Fell Again: How Much Lower Your $50,000 Home Equity Loan Payment Could Be Now

Borrowers with home equity loans are seeing lower monthly payments after the Fed's third rate cut in four months. A $50,000 loan now costs slightly less per month, but the…

The Great Housing Reset Is Coming—And It Could Change Everything by 2026

Following a four-year period of volatility in the US housing market, home sales are finally expected to recover gradually by 2026, according to a recent analysis by Redfin. Though buyers…

Mortgage Rates Take an Unexpected Dive, Fueling Housing Market Frenzy

Mortgage rates have fallen to their lowest levels in three years, according to Zillow’s latest report. This surprising shift has reignited activity in the housing market, defying seasonal trends. With…

Nearly 20% of Homes Cut Prices – Buyers Are Finally Getting a Break!

The housing market is witnessing a significant shift, with nearly 20% of homes slashing prices. This is providing buyers with more negotiating power than in previous years. With inventory on…

Mortgages Drop to New Lows How It Could Reshape Housing Trends

Recent fluctuations in mortgages are sparking interest among homebuyers. The effects of these changes, however, vary across different states and regions.

Property Taxes in the U.S.: How Rates Vary Across States

Property taxes can significantly impact homeownership costs, but rates differ widely across the U.S. Understanding these variations is key for homeowners.

Affordable Homes at Risk as Trump Seeks to Cut Key Rural Housing Program

A long-standing housing grant that has helped thousands of families own homes in rural America could soon disappear. The programme’s removal is part of Donald Trump’s latest budget proposal, sparking…

US Housing Market Swings to Buyers as Price Cuts Surge Across Key States

America’s housing market is no longer a seller’s paradise. As mortgage rates stay high and inventory climbs, a growing share of homes are selling for less than their listed price.…

Rent Prices Soar in These US Cities: Here’s Where the Biggest Increases Are

As rental prices rise across the US, certain cities are experiencing the sharpest increases. According to a recent Redfin report, areas like San Jose and Chicago are seeing substantial rent…

Housing Market Shift: The Impact of Eliminating Capital Gains Tax

A bold proposal to eliminate capital gains tax is sparking debate across the us housing market. while supporters see a chance to free up supply and ease mobility, critics fear…

American Homeowners Gain Major Financial Relief with the ‘One Big Beautiful Bill’

The One Big Beautiful Bill signed into law brings crucial changes for American homeowners, offering substantial tax relief. From raising the SALT deduction cap to securing a permanent mortgage interest…

When Will Mortgage Rates Drop Below 6%? Here’s What Experts Say

Mortgage rates have been hovering above 6% for the past two years, leaving many buyers wondering when they’ll drop back to more affordable levels. While some experts expect slight reductions…

How Property Taxes Affect Seniors and Where Relief Is Offered

Property taxes have risen sharply across the U.S., increasing the financial pressure on senior homeowners. Many states now provide exemptions or freezes to help seniors manage these costs, with several…

Emergency Housing Voucher Program May End Early, Threatening Housing Security for 60,000

The early end of the Housing Voucher Program could push thousands back into homelessness, as rising rents and inflation outpace the support once guaranteed by federal aid.

California Bill 90 Targets Housing Crisis by Offering Safe Parking for Homeless Students

California’s Bill 90 aims to address homelessness among students by providing designated parking areas for those living in their vehicles. The bill seeks to offer a safer alternative during the…

Housing Market Shows Troubling Slowdown Ahead of Spring 2025

The U.S. housing market continues to struggle amid high mortgage rates and slowing buyer demand. Rising uncertainty could weigh heavily on future sales trends.

EHV Crisis: 60,000 Americans Could Lose Rental Support Without Congressional Action

Tens of thousands who escaped homelessness or domestic violence now face losing their homes once again. The Emergency Housing Voucher scheme, a key pandemic-era support, is running out of time—and…

9 States Where Homeowners’ Insurance Costs Are Expected to Rise the Most in 2025

Investor sentiment worsened as Powell highlighted the inflationary risks of new tariffs. Technology stocks, particularly Nvidia and AMD, were hit hard due to export restrictions affecting chip manufacturers.

Housing Prices Drop in Some Cities: What This Means for Buyers and Sellers

The housing market is seeing significant changes, with prices dropping in key U.S. cities as supply levels rise. While some areas are experiencing price cuts, others continue to struggle with…

Generational Shift in the Housing Market : Baby Boomers Outpace Millennials

More than half of older Baby Boomers are buying homes entirely with cash, giving them a decisive edge over younger, loan-dependent buyers. Millennials, facing higher living costs and borrowing challenges,…

In These 32 U.S. Cities, Buying a House Is Cheaper Than Renting

In 32 U.S. cities, buying a home proves to be more cost-effective than renting, according to a recent study. The findings highlight significant savings, particularly in areas with lower home…

New Strategy From Trump Administration Promises to Tackle America’s Housing Shortage

The Trump administration has unveiled a strategic plan to address America’s long-standing housing crisis. By utilizing underused federal lands across the country, the initiative aims to boost affordable housing availability.…

Massive Rate Cut Unveiled by Major Aussie Bank—Here’s What You Need to Know

A major bank has just made a bold move, slashing home loan rates in a competitive shake-up. The cut puts pressure on rival lenders, but not everyone will qualify for…

Affordable Housing Crisis Deepens as Trump Halts Key $1B Program

A federal program providing essential funding for affordable housing repairs has been halted under the Trump administration, leaving thousands of low-income tenants in uncertainty. Property managers warn that the move…

Montana Moves to Shift Tax Burden from Homeowners to Second-Home Investors

Montana is considering a major tax shift that could ease the burden on homeowners while raising costs for second-home owners.

What Trump’s Auto Loan Tax Plan Means for Your Wallet

Trump's tax deduction plan for car loans sparks debate. Critics warn it benefits the wealthy, but its full impact remains uncertain.

Mortgage Rates Drop Again: What It Means for Buyers and Homeowners

Mortgage rates are falling for the seventh week, hinting at relief for buyers. Economic shifts and market trends shape what’s next.

How to Navigate PMI Costs When Buying a Home ?

While many first-time buyers anticipate mortgage payments, property taxes, and maintenance costs, PMI is an additional expense that can catch them off guard.

The Impact of Tariffs on US Housing Affordability

New tariffs on imports from China, Canada, and Mexico are driving up construction costs, impacting home prices and affordability.

What buyers need to know about today’s housing market

Rising house prices, fluctuating mortgage rates, and shifting market dynamics shape today’s housing landscape. Key factors reveal what buyers should know.

Homeowners Sit On Record Equity While Buyers Struggle with Rising Costs

Homeowners hold record equity, yet borrowing remains low. Meanwhile, buyers face rising mortgage rates and dwindling housing options.

Millions at Risk? The Impact of HUD Cuts on Affordable Housing and Homelessness

Federal budget cuts are hitting HUD hard, threatening essential housing programs. Advocates fear the impact on renters, homeowners, and struggling communities.

Here’s America’s Fastest-Growing Housing Markets in 2025

Some US housing markets are seeing unexpected growth, with certain areas outperforming the national average. Arizona and Florida lead the charge.

The Hidden Cost of Trump’s Steel and Aluminum Tariffs on U.S. Housing

The U.S. housing market faces new pressures as President Trump’s 25% tariffs on steel and aluminum imports could push construction costs even higher. With the country already battling a severe…

The New Home Sales Boom: Will More Homes Lead to Lower Prices?

New home sales surged in 2024, marking the highest level in three years and offering a glimpse of hope for buyers in a tight housing market. Despite high mortgage rates,…

Why Mortgage Rates Are Still a Struggle for Homebuyers in 2025

Despite a small decline in mortgage rates, the US housing market continues to face serious challenges. With high interest rates and limited inventory, Barbara Corcoran warns that both buyers and…

Homeownership and Wealth: Why Americans Still Aspire to Own a Home

Homeownership remains a powerful symbol of the American Dream, cherished by 75% of Americans despite rising financial barriers. Across generations, the aspiration endures, tied closely to long-term wealth and stability.…

America’s Homelessness Crisis: A Challenge Beyond Policy and Wildfires

Wildfires, rising rents, and shifting policies have intensified America’s homelessness crisis, leaving more people unhoused than ever before. As federal leadership wavers, local communities fight to fill the gaps. Can…

US Housing Market Braces for Impact Amid Soaring Rates and Rising Costs

The US housing market faces a storm of high mortgage rates, soaring home prices, and dwindling sales, leaving affordability at a breaking point. As the Trump administration takes office, promises…

‘This Is a Historic Moment’: California Unveils Sweeping Homeowner Insurance Mandate

California is making waves with a bold new insurance mandate that could change the game for homeowners in wildfire-prone areas. The policy, hailed as a “historic moment,” promises expanded coverage…