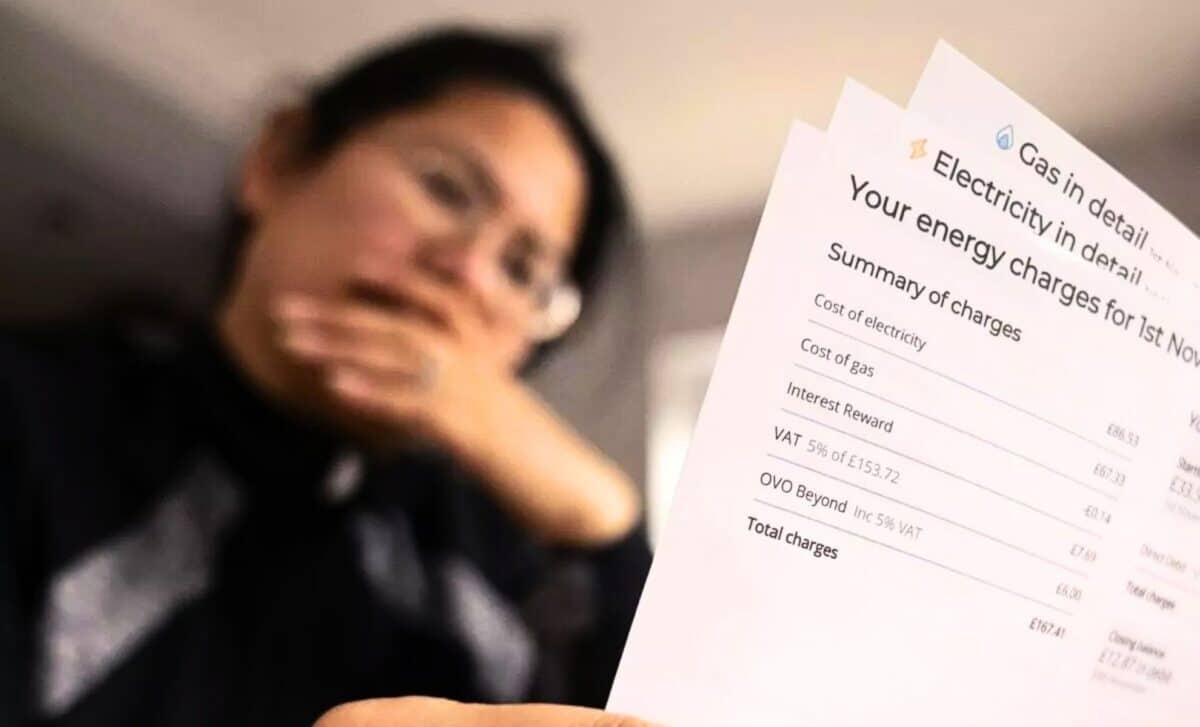

Facing the harsh realities of winter, major UK energy suppliers are stepping up with a groundbreaking initiative: a £500 million fund designed to lend money to customers grappling with spiraling energy costs. As temperatures drop and household budgets tighten, this move could be a lifeline for many struggling with the ongoing cost-of-living crisis.

£500m Energy Fund: What’s in it for You?

For many years, the UK energy industry has faced criticisms, with households affected the most with high costs. Nowadays, companies are trying to soften the impact by providing flexible payment plans and also cash assistance.

This is not a giveaway, rather, think of it like borrowing money which is meant to help people pay their heating bills during winter. Customers will have the option of deferred payments that would put a bow on cost by managing it into the spring and over the months that follow.

Insiders in the industry say this strategy is quite deterministic, as it appreciates that a section of the consumers cannot pay for the products under the prevailing pricing structures. And yet, a few holdouts do not believe this is the solution to the lightning of the upcoming months’ financial burden either.

How Can You Access the Fund

Accessing this support won’t be automatic. Customers must contact their energy providers to discuss eligibility and terms. Each company has its own criteria, making proactive communication essential for those in need.

Additionally, energy firms are emphasizing support for vulnerable groups, including low-income households and individuals reliant on medical equipment. It’s a step towards addressing a systemic issue, but how far it will stretch remains to be seen.

Concerns Over Long-term Impact

There has been a consensus among many people that the £500 million fund is a thrilling approach, but many are not on the optimistic shade. Consumer welfare advocates caution about the dangers of putting up payments for when households are already in debts behind and prolongs the cycle.

Still, many supporters of this view do not believe so and argue that there should be maximum voices of change such as price control measures or subsidies that boost the energy market without market restrictions.

Whereas other people see this set of measures as just a political fix for the energy suppliers, why haven’t they put measures before? But, “It’s a temporary fix for a long-term problem,” one industry expert noted.

Totally agree I’m classed as vulnerable I have borrowed electric from British gas but it just adds to the weekly amount on my meter so yes help at once but long term it doesn’t help. I can’t afford electric and gas