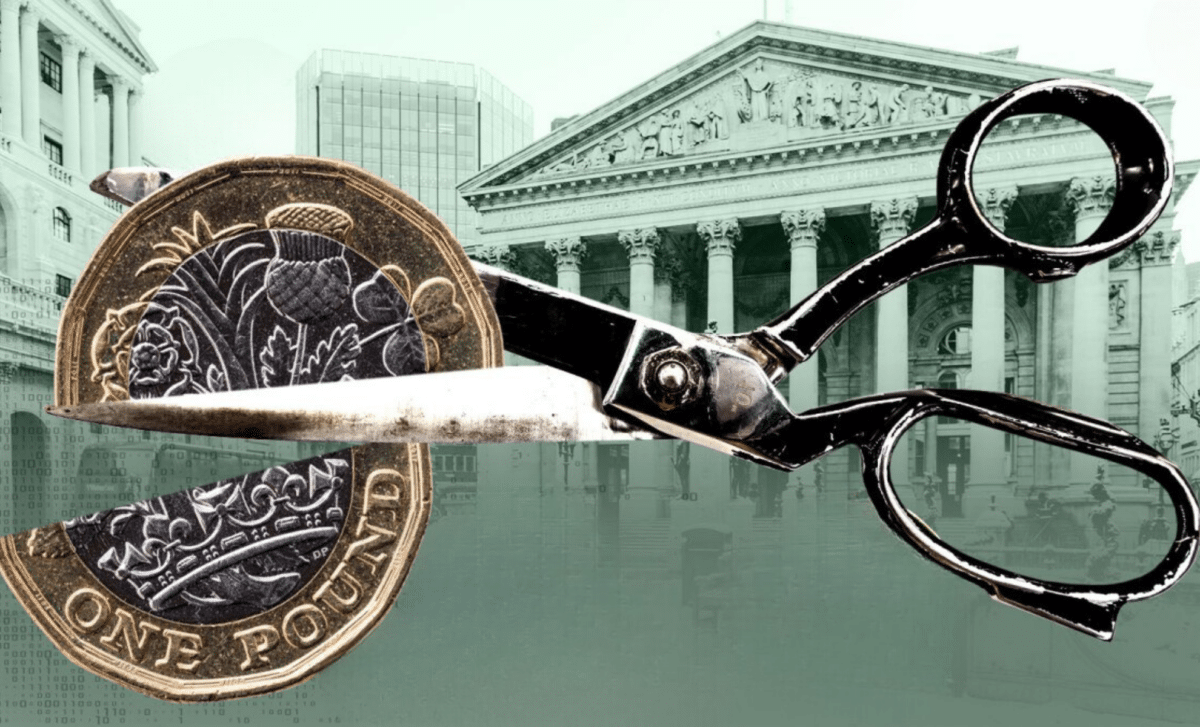

In a cautionary note, Swati Dhningra, a policymaker at the Bank of England, has expressed concerns about the potential consequences of delaying interest rate cuts until inflation further subsides. Dhingra warns that such hesitation could pose a risk of subjecting the UK economy to a challenging “hard landing”.

Swati Dhingra Urges Prudent Rate Cuts

Swati Dhingra who advocated for a rate cut from 5.25% to 5%, expressed her viewpoint, acknowledging the potential challenges in the trajectory of easing inflation but emphasizing its clear downward trend.

Speaking at an MNI Connect event, she highlighted the drawbacks of waiting for lagging indicators of domestic relative price growth to sharply decline before implementing rate cuts. Dhingra cautioned against this approach, noting that it comes with the costs of missed opportunities to enhance living standards and the risk of diminishing future supply capacity.

Ms Dhingra noted that UK consumption has yet to rebound to pre-pandemic levels, distinguishing it from the recoveries observed in the US and the eurozone. She further highlighted that the repercussions of the recent string of 14 consecutive rate hikes would persist for a considerable duration, contributing to the prolonged effects on the economy.

Dhingra highlighted: “The restrictive stance of monetary policy is expected to continue weighing on economic growth and living standards for more time, even if moderation starts now.

“In my view, the evidence to err on the side of overtightening is not compelling, as it often comes with hard landings and scarring of supply capacity.”

Bank of England’s Rate Divergence: Dhingra’s Insights Amid Economic Challenges

In its February session, the Bank’s Monetary Policy Committee maintained rates at 5.25%, revealing a divided stance, with Ms. Dhingra advocating for a cut while two policymakers called for an increase.

The prevailing concern among the majority of the committee revolved around uncertainties related to wage growth and services prices. Their primary focus was on assessing whether these factors were decelerating sufficiently to facilitate a return to the targeted 2% inflation rate.

Ms Dhingra said: “The path of inflation is unlikely to be smooth, but it looks to be clearly downwards and in line with disinflation in other advanced economies owing to some of the common global shocks that have occurred.”

Ms. Dhingra emphasized that the sluggish economic output is expected to contribute to a further slowdown in inflation. Recent figures disclosed a recession in the UK at the close of 2023, marked by consecutive quarters of falling output. Despite this, Ms. Dhingra pointed out positive signs, aligning with recent statements from Bank Governor Andrew Bailey.

She highlighted more recent economic indicators, which offer reassurance that the previous quarter’s contraction may not be indicative of a rapid and imminent deterioration in the demand outlook.

However, she noted,“Overall, the outlook for demand remains weak and less resilient than previously assumed.

“This further reduces prospects of embedded persistence and raises the downside risks to living standards from keeping policy tight.”