Today, in a move eagerly watched by investors worldwide, the SEC’s Twitter account made a groundbreaking announcement: the approval of Bitcoin ETFs for listing on national securities exchanges. With the crypto community and financial markets holding their breath for an official SEC decision on this matter, the tweet has stirred a whirlwind of reactions. But the critical question arises: is this announcement a long-awaited reality, or just another illusion in the ever-unpredictable digital world?

For years, the crypto industry and investors have been anticipating the SEC’s stance on Bitcoin ETFs. The approval of such funds is seen as a monumental step towards mainstream acceptance and integration of cryptocurrencies into traditional investment portfolios. This anticipation has kept the market on edge, with every hint from the SEC closely analyzed for potential implications.

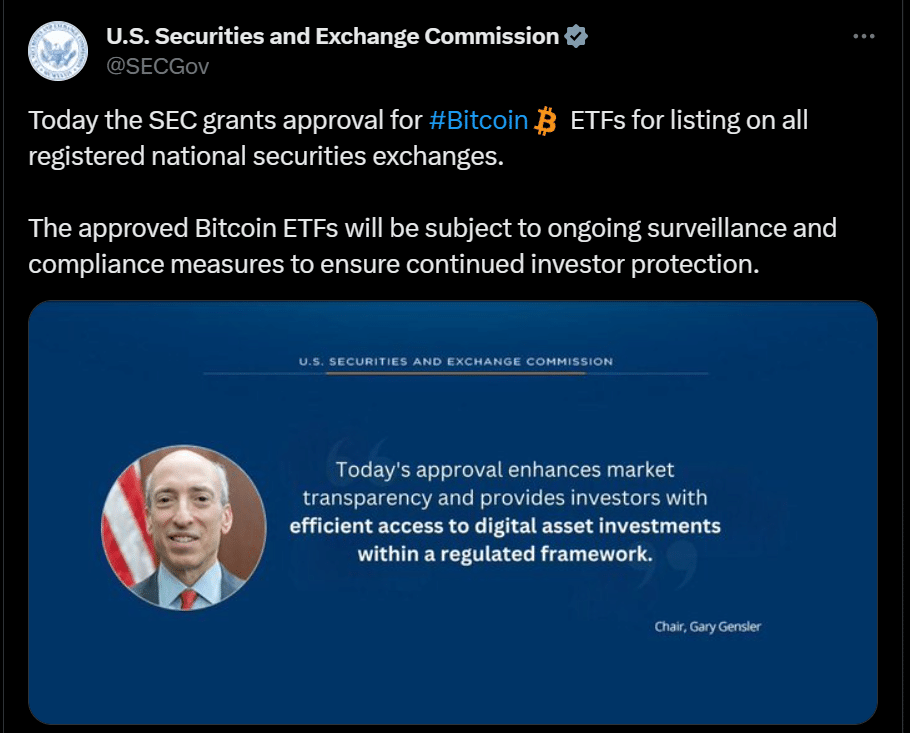

On January 9, 2024, at 2:11 PM UTC+1, the SEC’s official Twitter handle, @SECGov, sent out the long awaited tweet. It quoted Gary Gensler, the SEC Chair, saying, “Today’s approval enhances market transparency and provides investors with efficient access to digital asset investments within a regulated framework.” The message appeared authentic and swiftly caught the attention of the global financial community.

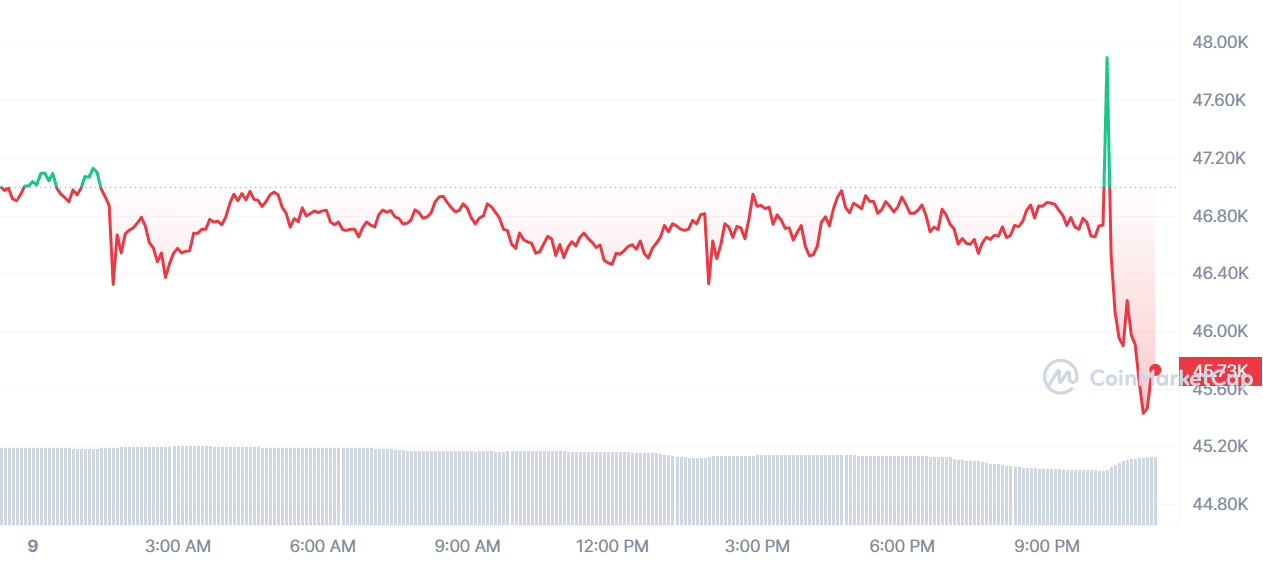

The tweet’s impact was immediate. The cryptocurrency market, particularly Bitcoin, experienced a swift surge in price. Investors, reacting to what they believed was a legitimate announcement, rushed to adjust their strategies, leading to heightened market activity and volatility.

However, the jubilation was short-lived, as Chair Gary Gensler published a clarification, stating that the tweet was a result of their Twitter account being compromised, confirming that the tweet regarding Bitcoin ETFs was unauthorized and did not represent the SEC’s decision or views. This revelation brought a swift end to the market frenzy, with Bitcoin’s price retracing below the $46,000 mark.

Following the fraudulent tweet, legal experts speaking to Fox Business have emphasized that the SEC itself may need to launch an investigation for potential market manipulation after the false claim of approving the first Bitcoin ETF was circulated. Charles Gasparino, a notable financial journalist, suggested that the SEC’s failure to approve such ETFs in the near future would be unprecedented, given the stage that these applications have reached.

BREAKING: Securities lawyers tell @FoxBusiness the @SECGov will have to investigate itself for market manipulation after moving the price of $BTC up and down following the hacked tweet that it had approved the first spot BTC ETF and then saying it was fake. That said, for the SEC…

— Charles Gasparino (@CGasparino) January 9, 2024

The SEC’s actual decision on Bitcoin ETFs remains a pivotal and pending event, with numerous asset managers having submitted their applications. As of now, the crypto community continues to wait for an official statement.