Americans have until April 15 to file for the $1,400 Recovery Rebate Credit, a critical deadline for those who are still eligible to receive this much-needed financial relief.

The IRS deadline marks the end of a three-year period for taxpayers to claim credits and refunds for the 2021 tax year, including individuals who may have missed out on the original stimulus payments.

According to Newsweek, some Americans who were eligible for these payments never received them, particularly those who did not file a 2021 tax return or were unaware of their eligibility. Now, time is running out for those who still wish to claim their checks.

Why This Matters

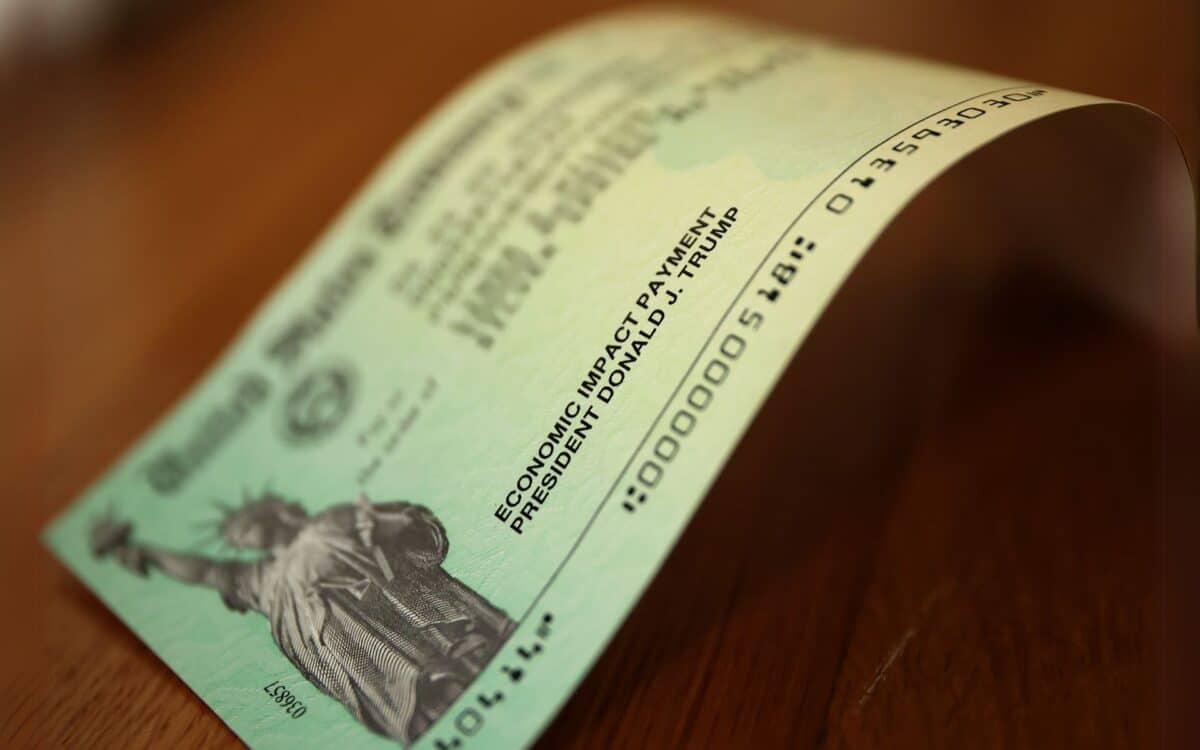

During the COVID-19 pandemic, the U.S. government issued several rounds of stimulus payments to provide financial relief.

However, not all eligible Americans received their $1,400 checks. Many individuals who did not file a 2021 tax return, or who were unaware of their eligibility, missed out on the benefit. With tomorrow’s deadline fast approaching, those who have not yet filed are urged to take action now.

Kevin Thompson, a finance expert and the founder and CEO of 9i Capital Group, previously told Newsweek :

The most important thing about the Recovery Rebate Credit is that it’s refundable—meaning you can get the credit even if you don’t owe taxes. Most credits and rebates only reduce your taxable income to zero, but refundable credits go beyond what you owe, and the extra amount comes back to you as a refund.

Who Is Eligible to Claim the $1,400?

To qualify for the $1,400 Recovery Rebate Credit, you must file a 2021 tax return. This is true even if you were not required to file taxes but still meet the eligibility criteria. The IRS has set an income threshold for the full $1,400 benefit—individuals earning up to $75,000 in adjusted gross income (AGI) qualify for the full amount.

For married couples, the threshold is $150,000. Those earning above these limits may receive a reduced payment.

What If You Already Filed but Missed the Credit?

If you filed a 2021 tax return but did not claim the Recovery Rebate Credit, you may still be eligible for the $1,400 payment. In such cases, the IRS has already issued special payments to some individuals in December.

The IRS allocated a total of $2.4 billion in special payments for 1 million people who missed out on claiming federal stimulus checks. These individuals should have received their payments by the end of December 2024 or by late January 2025.

Alex Beene, a financial literacy instructor for the University of Tennessee at Martin, previously told Newsweek :

While it’s inconceivable to millions of Americans who received stimulus checks during the pandemic, there are still a small group of taxpayers who qualified for payments who never received them.

What Happens If You Miss the Deadline?

After April 15, any unclaimed stimulus payments will return to the U.S. Treasury. Those who miss this final chance will forfeit the $1,400 benefit. There will be no additional opportunity to claim the check for the 2021 tax year.

For those who file on time, the stimulus payments will be sent out either through paper checks or direct deposits based on the banking information provided in their 2024 tax return.