The U.S. Federal Reserve’s decision to keep interest rates steady has drawn attention amid rising economic uncertainty. On March 21, the central bank held its benchmark rate at 4.25%-4.50%, with Jerome Powell highlighting elevated challenges in forecasting due to shifting policies.

According to Reuters, the impact of recent tariffs introduced under the Trump administration is contributing to slower growth and inflation. This marks another step in navigating a period of heightened unpredictability for the U.S. economy.

The Fed’s Stance on Interest Rate Cuts

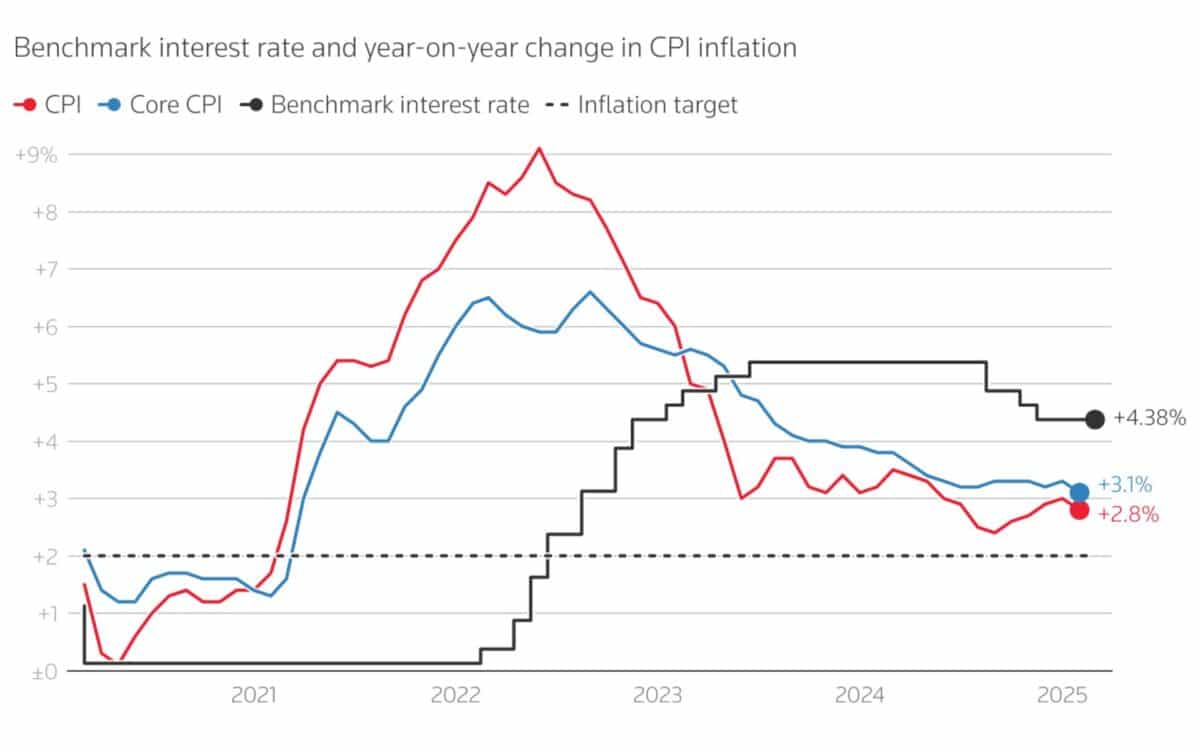

Following the Fed’s decision to leave rates unchanged, major brokerages have maintained their predictions for a slower pace of interest-rate cuts. Traders expect two rate cuts of 25 basis points each for the year, according to data compiled by LSEG.

The Federal Open Market Committee (FOMC) is scheduled to meet again on May 6-7.

The Fed’s forecast for economic growth has been revised down to 1.7% for the year, down from 2.1% in December, with slightly higher unemployment projected by the end of the year.

This is in line with the revised inflation expectations for 2027, which are now projected at 2.7% compared to 2.5% in December.

Trump Administration’s Policies and Their Impact

Federal Reserve Chair Jerome Powell pointed to the Trump administration’s tariff policies as a key factor contributing to the higher inflationary pressures.

Trump’s extensive import tariffs, including a planned 25% tax on goods from Mexico and Canada, have been described as an “exogenous shock,” meaning they are coming from an external source.

These tariffs are expected to have a lasting impact on consumer prices, potentially feeding into inflationary psychology among businesses and families.

Powell noted that the tariffs could raise the average tax rate on imports to levels not seen since the Great Depression. Some of these levies have already been implemented, and the remaining tariffs are set to take effect in early April.

The Fed will be closely monitoring how much of these tariff impacts pass through to consumer prices, especially as retaliatory measures from other countries are likely to follow.

In response to the situation, President Donald Trump posted late on Wednesday on his Truth Social platform :

The Fed would be MUCH better off CUTTING RATES as U.S. Tariffs start to transition (ease!) their way into the economy. Do the right thing.

Economic Outlook and Projections

Despite these challenges, Powell stated that overall economic data remains solid, with the unemployment rate at 4.1%, signaling a balanced job market.

However, inflation expectations have risen in the early weeks of the Trump administration, though longer-term inflation measures, which the Fed closely monitors, have not changed significantly.

Powell explained the difficulty of making economic projections in such an uncertain environment :

There is just really high uncertainty. What would you write down?

He said during a press conference after the Fed’s latest two-day policy meeting.

I mean it’s just… really hard to know how this is going to work out.

Powell emphasized that the Fed’s current policy stance is well-positioned to manage the risks posed by the uncertainty in the economy, stating,

We’re not going to be in any hurry to move,

He added that the Fed was prepared to adjust its stance as new data becomes available, either tightening policy if inflation persists or easing it if unemployment rises.

Our current policy stance is well-positioned to deal with the risks and uncertainties we face… The right thing to do is to wait here for greater clarity about what the economy is doing.

While the central bank remains cautious, Powell also acknowledged that there could be

A delay in further progress over the course of this year.

Fed officials also announced that they would slow the drawdown of its $6.81 trillion balance sheet, a process known as quantitative tightening. This move was not unanimously agreed upon, with Fed Governor Chris Waller dissenting on this policy shift.

The Fed is as lost in the wilderness as the rest of us trying to decipher the continual shifts in economic policy from 1600 Pennsylvania Avenue,

said Omair Sharif, president of Inflation Insights, referring to the street address of the White House.

Beyond the cut to median growth this year and the boost to median inflation, the most telling aspect of the (projections) is the shift higher in uncertainty.