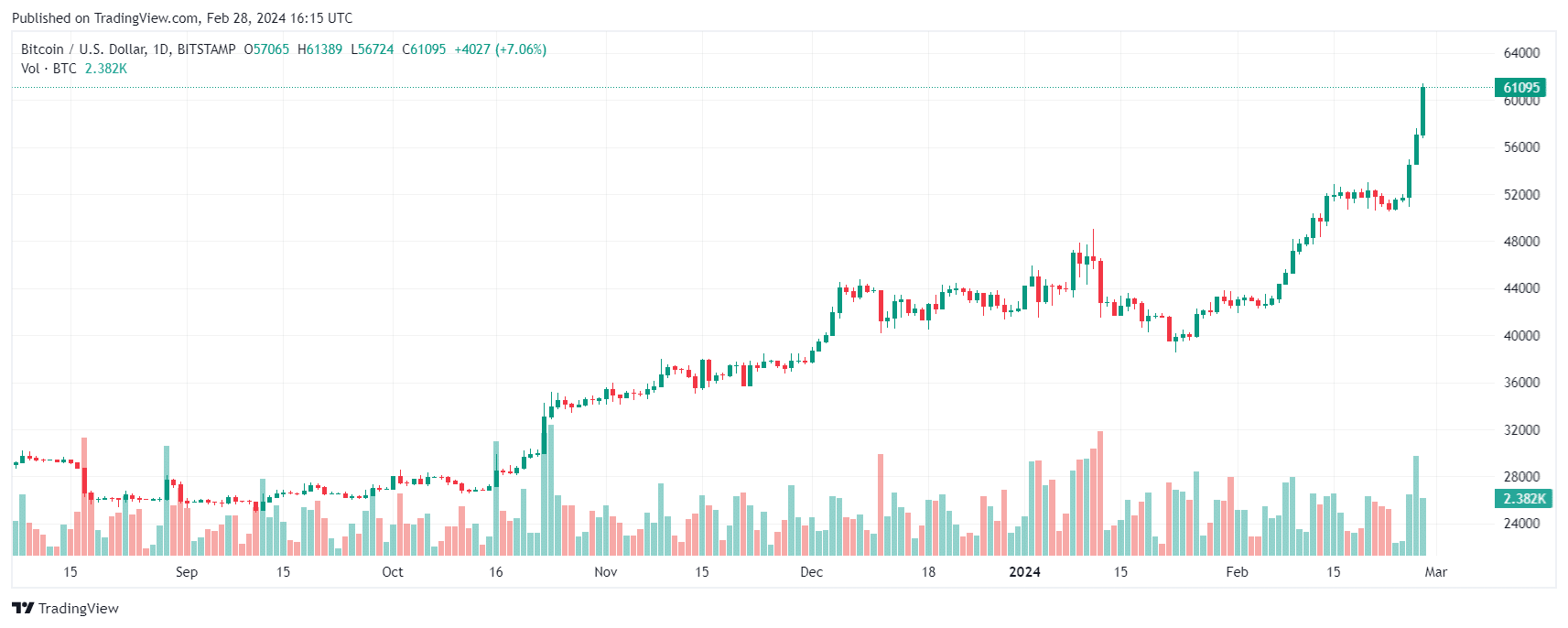

In a historic moment for the cryptocurrency world, today, 28 February 2024, bitcoin surged to over $60,000. It has increased by 36% since the beginning of 2024 and by more than 160% compared to the previous year. This marks a significant milestone not seen in over two years.

Bitcoin Price Hits New Milestone of $60,000

Bitcoin’s price surge continued as it climbed 7% to $61,000, its highest level since November 2021, when it almost touched the $70,000 mark. Bitcoin was also on track for its biggest weekly gain in a year, rising 18.5% since 21st February.

Part of the reason for this surge may have been an increase in interest in bitcoin exchange traded funds (ETFs). Trading volumes in major bitcoin ETFs, including those offered by Grayscale, Fidelity and BlackRock, have increased significantly this week.

Traders piled into bitcoin in anticipation of April’s halving event. This mechanism is designed to slow down the release of the cryptocurrency into the market. Moreover, the expectation that the Federal Reserve will implement a series of interest rate cuts this year has boosted investor appetite for higher-yielding and more volatile assets. Often, when interest rates are low, investors turn to riskier investments with the potential for higher returns. Bitcoin and other cryptocurrencies are seen as such investments.

Approximately 110 million shares of the three largest bitcoin ETFs changed hands on Monday and Tuesday alone, representing more than half the volume of shares traded in the market’s most valuable companies, including Apple, Microsoft and Nvidia.

“Bitcoin is being driven by steady inflows into the new spot ETFs and the prospect of the April halving event and June Fed rate cuts,” said Ben Laidler, global markets strategist at retail investment platform eToro.

Growing Institutional Interest

Bitcoin’s rise to $60,000 reflects growing institutional interest in cryptocurrencies as an emerging asset class. Major investment firms such as BlackRock, Fidelity and MicroStrategy have recently purchased significant amounts of bitcoin, signalling their belief in its long-term value. As more institutional investors enter the market, demand for bitcoin is likely to continue to grow.

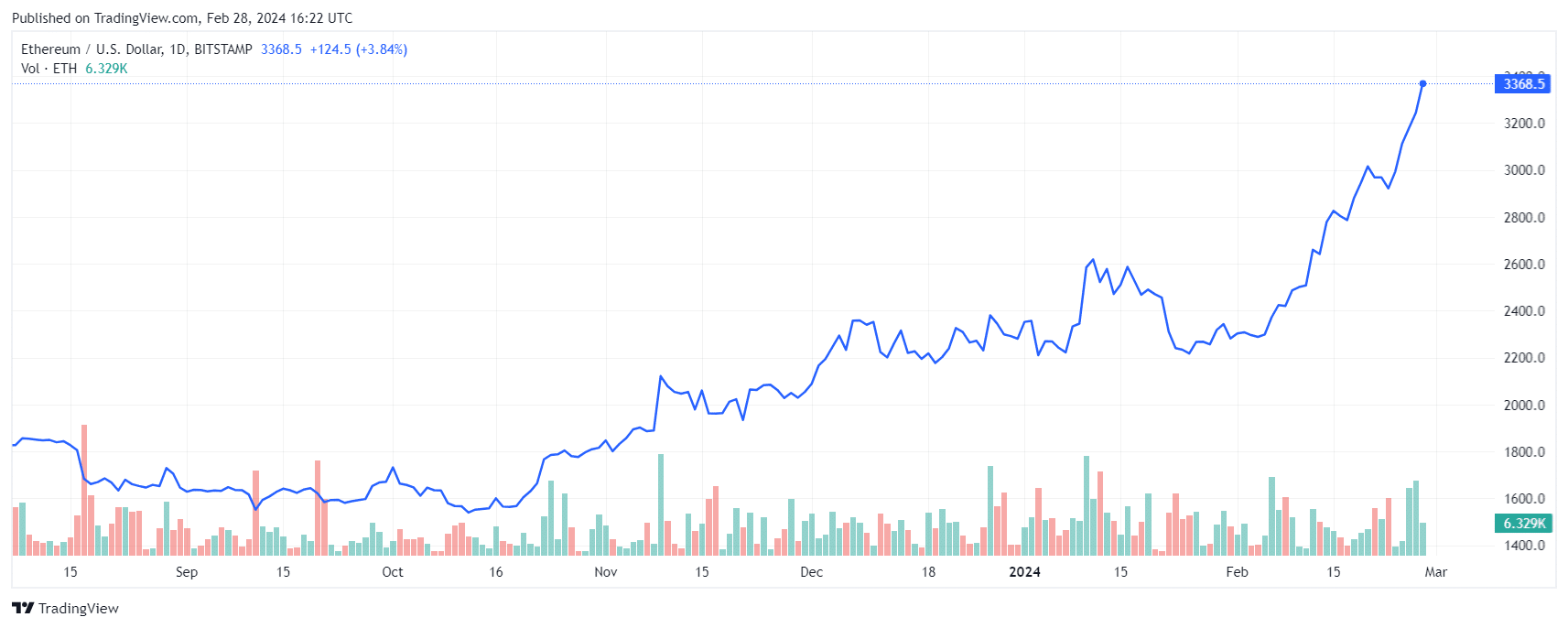

Ethereum’s Parallel Surge

As the events related to Bitcoin continue, the price of Ethereum climbed approximately 3.2% to $3,353, marking a new two-year high. Ether gained nearly 47% over the course of February, the largest monthly increase since July last year.

Market analysts believe that this surge is due to investors’ optimism that US regulators will soon approve exchange-traded funds (ETFs) that directly track the spot price of Ether. If approved, Ether ETFs would provide institutional investors and others with greater accessibility to invest in the cryptocurrency, potentially leading to higher demand and trading volume.

Should You Invest in Bitcoin?

Deciding whether to invest in Bitcoin depends on how much risk you want to take. Bitcoin is a volatile asset and its price can fluctuate wildly. However, bitcoin offers an attractive opportunity for investors looking for high potential returns.

Experts recommend allocating only a small percentage of your portfolio, perhaps 1-5%, to bitcoin if you decide to invest. Furthermore, it’s important to do your research, understand the risks and take a long-term view. For most mainstream investors, Bitcoin should not make up the majority of your portfolio.