In 2023, Bitcoin (BTC) not only emerged from its longest-ever bear market, but also showcased a stunning recovery, marking a year of resilience. Exploring the key milestones, this article delves into the pivotal moments and factors that shaped Bitcoin’s trajectory through the year, painting a picture of a digital asset that continues to attract both retail and institutional interest despite its volatile nature.

Bitcoin’s Recovery and Market Dynamics

The year 2023 began on a tumultuous note for Bitcoin, recovering from a post-FTX crash low around $16,000. Despite facing early challenges, including liquidity crises in crypto-friendly financial institutions like Silicon Valley Bank and Silvergate Capital, Bitcoin’s price steadily climbed, reaching $24,800 in the first quarter. However, it’s important to note that this recovery was not without its tests, as the price briefly dipped back to $20,000 before rebounding strongly.

A pivotal moment came in June, with BlackRock, the world’s largest asset manager, filing for a spot Bitcoin ETF. This move, significant given BlackRock’s market influence, rekindled optimism and spurred a rally, pushing Bitcoin above $40,000 by October, a level unseen since April 2022.

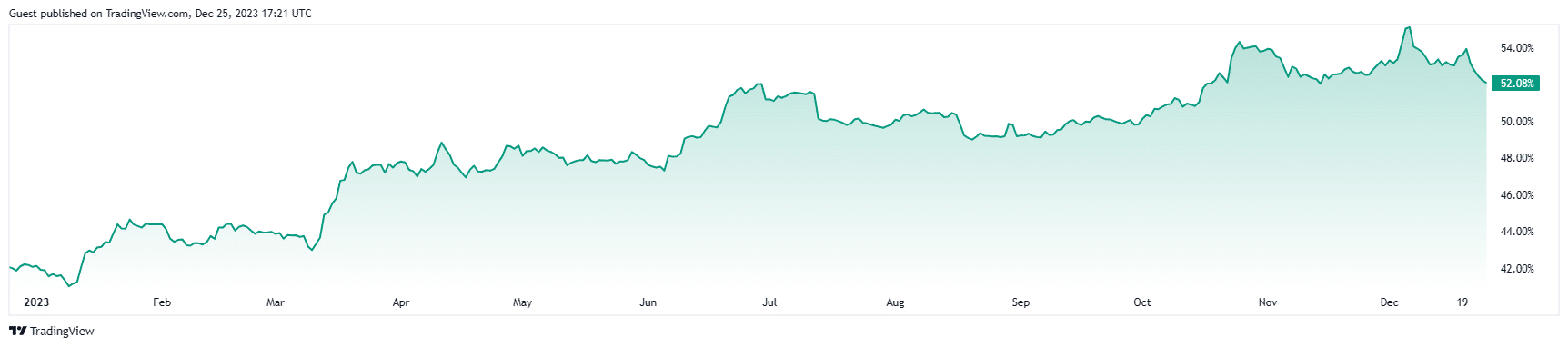

Bitcoin Growing its Dominance in the Crypto Market

Throughout 2023, Bitcoin’s dominance in the cryptocurrency market was unmistakable. Its market capitalization surged from 40% at the beginning of the year to over 52% by year-end. This trend is indicative of Bitcoin’s role as a market leader, often setting the tone for the broader crypto market.

Volatility Trends, Investor Sentiment and User Growth

In August, Bitcoin’s 30-day annualized price volatility reached an all-time low, mirroring patterns observed in previous market cycles. This period of low volatility, however, preceded a significant price movement, culminating in a rapid ascent to $45,000 in October.

A notable trend in 2023 was the consistent increase in Bitcoin addresses with a non-zero balance, signaling ongoing adoption and usage growth. Additionally, the creation of new Bitcoin addresses reached highs not seen since February 2021, pointing to a robust and active user base.

Bitcoin Mining, NFTs and Ordinals: Behind a Revenue Surge

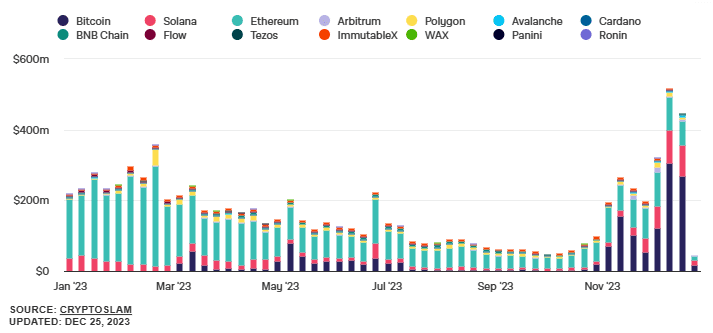

A significant development in 2023 was the surge in Bitcoin miners’ revenue, particularly due to the increase in transaction fees linked to the Bitcoin Ordinals inscription frenzy. This trend not only boosted miners’ revenue but also highlighted the growing popularity of Ordinals, which allow users to inscribe data onto the Bitcoin blockchain.

Reflecting the overall optimism in the Bitcoin ecosystem, mining stocks such as Bitfarms Ltd., Marathon Digital Holdings, and others saw impressive gains, outperforming Bitcoin itself. Factors such as the upcoming Bitcoin halving event in April 2024 and the Ordinals trend played crucial roles in driving investor sentiment.

2023 witnessed the rise of Bitcoin NFTs through the Ordinals protocol. Despite some criticism from within the Bitcoin community, the trading volume of Bitcoin NFTs surpassed that of Ethereum’s in November, marking a significant milestone for Bitcoin’s role in the NFT market.

Current Bitcoin Price and Year-End Expectations

As of December 25, 2023, Bitcoin is trading at $43,647, beginning the Christmas holidays with a significant test of support. This volatility, marking a year where BTC/USD is up more than +154%, sets a dynamic stage for the year’s end. Traders are eagerly eyeing the price action, with Bitcoin fluctuating in a range between $40,000 and a 19-month high of $44,730. This performance reflects a year of substantial growth for Bitcoin, with remarkable network expansion and mining profitability.

On-chain metrics are also showing bullish signs, suggesting that the new bull market might still be in its early stages. With major events like the decision on the United States’ first spot price exchange-traded fund (ETF) and the next block subsidy halving on the horizon, the market is at a pivotal point.

As we look back at Bitcoin’s performance in 2023, it’s clear that the digital asset has not only survived its toughest challenges but also thrived, attracting new users and retaining its position as the leader in the cryptocurrency market. Despite the criticisms and regulatory uncertainties, Bitcoin’s resilience and adaptability continue to make it a focal point of interest in the ever-evolving world of digital currencies.