In the aftermath of a recent interest rate cut by the Bank of England (BOE), more mortgage offers with interest rates under 4% are becoming commonplace, which can be nothing but bad news for banks. Therefore, this trend is going to be favourable for those targeting property-buying, with such forecasts of lower rates further appearing in the future.

This week, the average rate for a two-year fixed deal stood at 5.25%, down from 5.74% last week, while five-year fixed rates dropped to 4.77%, from 5.27%, according to Uswitch.

Bank of England’s Interest Rate Decision

In August, the Bank of England reduced its base interest rate to 5%, marking the first cut in four years. The decision, which was narrowly approved with a 5-4 vote from the Monetary Policy Committee (MPC), signals potential future cuts. Analysts predict mortgage rates could fall to around 3.5% by the end of the year if two additional rate cuts materialize.

New Mortgage Offers Below 4%

NatWest and Barclays have already introduced significant rate cuts. NatWest is offering a five-year deal at 3.77%, while Barclays has also reduced its rates to help those looking to buy or move. The competition is heating up, which could benefit homebuyers.

According to Stephen Perkins of Yellow Brick Mortgages, lenders are eager for business, making it an ideal time for prospective buyers to act. “With competition between lenders heating up, now is a fantastic time for borrowers to make their property dreams a reality,” he said.

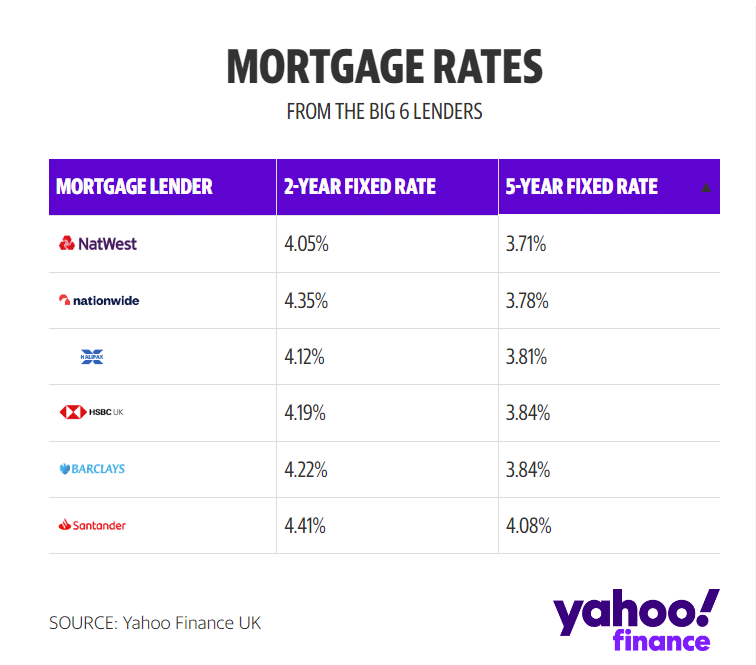

Breakdown of Current Mortgage Offers

HSBC:

- Five-year deal: 3.84% (3.81% for Premier Standard account holders).

- Two-year deal: 4.19% with a £999 fee, assuming a 60% loan-to-value (LTV) ratio.

- 95% LTV deal: Two-year fix at 5.84% or five-year fix at 5.29%, reflecting the higher risk for lower deposits.

Nick Mendes from John Charcol noted that HSBC’s low rates, combined with manageable fees, make their offerings particularly appealing.

NatWest:

- Five-year deal: 3.71% with a £1,495 fee, down from last week’s 3.83%.

- Two-year fix: 4.05%, down from 4.21%.

To qualify, borrowers need at least a 40% deposit, and the minimum loan amount is £250,000.

Santander:

- Five-year deal: 4.41% with a £999 fee (unchanged).

- Two-year fix: 4.08% with the same fee.

Barclays:

- Five-year deal: 3.84% for buyers with a 40% deposit.

- Two-year deal: 4.22%, unchanged from previous weeks.

Nationwide:

- Five-year deal: 3.78% with a £1,499 fee, requiring a 40% deposit for loans over £300,000.

- Two-year fix: 4.53%, down from 4.65%.

- Additional deals: Various fixed-rate options for new customers, existing customers, first-time buyers, and remortgages are available, ranging from 3.83% to 4.90%, depending on LTV and term length.

Halifax:

- Two-year deal: 4.12% with a £999 fee for first-time buyers, lower than last week’s 4.36%.

- Five-year deal: 3.81% for buyers with a 40% deposit.

- Ten-year deal: 4.93%, unchanged.

Cheapest Deal on the Market

NatWest currently offers the lowest mortgage rate at 3.71%, though it requires a 40% deposit. Nationwide follows with a 3.78% rate for a five-year fixed deal. With the average UK house price at £291,268, a 40% deposit would amount to approximately £116,500, making these deals accessible primarily to those with substantial savings.

Support for First-Time Buyers

Yorkshire Building Society has introduced a new product allowing first-time buyers to purchase properties valued up to £500,000 with just a £5,000 deposit. This 1% deposit option could significantly ease the path to homeownership.

Other lenders are also stepping up. April Mortgages now offers loans up to six times an applicant’s income, with rates starting at 4.99% and deposits as low as 5%. Skipton Building Society is similarly allowing first-time buyers to borrow up to five-and-a-half times their income.