Barclays is set to increase its mortgage rates starting tomorrow, impacting various fixed-rate deals for home buyers. This move, as the market is changing, may lead to many prospective buyers being able to qualify for a mortgage or affect the competition of the mortgage.

Barclays Raises Mortgage Rates

Barclays currently offers the second lowest five-year fixed mortgage rate for buyers with a minimum deposit of 40%, which is set to rise from 3.85% to 3.96% tomorrow. For a £200,000 mortgage over 25 years, this translates to a monthly payment increase from £1,029 to £1,051.

Additionally, the lender’s competitive 3.85% deal for those with a 25% deposit will increase to 4.05%, while home buyers with a 10% deposit will see the rate on the 4.39% deal rise to 4.59%.

The Impact on Two-Year Fixes

The two-year fixed rates are also impacted, with Barclays raising its lowest rate from 3.9% to 4.1%. This leaves only Santander and Nationwide with two-year fixes below 4%. For buyers with a 15% deposit, the market-leading rate will increase from 4.4% to 4.6%.

Following Barclays’ announcement, Halifax also declared rate increases on two- and five-year fixed products, with adjustments ranging from 0.11 to 0.24 percentage points starting tomorrow. This trend suggests a potential decline in the availability of sub-4% deals.

Reasons Behind the Rate Increase

Mortgage rates had been on a downward trajectory since summer. From July to last week, the cheapest five-year fixed rate dropped from 4.28% to 3.68%, and the lowest two-year fix fell from 4.68% to 3.84%. However, rates are now on the rise again.

This shift is attributed to the increasing Sonia swap rates, which reflect future interest rate expectations. When these swap rates rise, fixed mortgage rates typically follow suit. As of October 14, five-year swaps were at 3.8%, while two-year swaps reached 4.02%, an increase from the previous month’s 3.39% and 3.73% respectively.

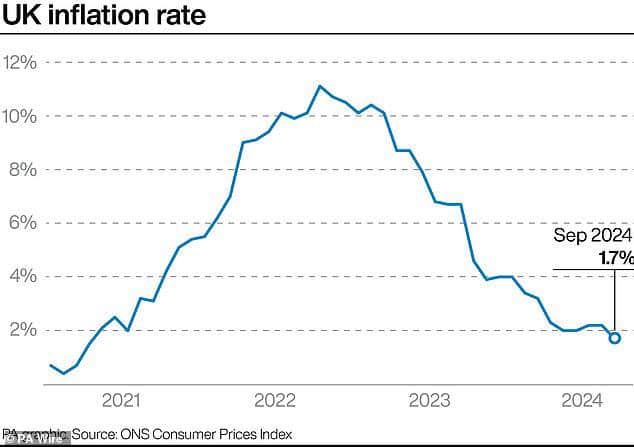

Despite these increases, recent data from the Office for National Statistics (ONS) showed inflation decreasing to 1.7% for the year ending September, down from 2.2% in August. This was the first time inflation dipped below the target since April 2021 and was lower than the expected 1.9%.

Experts suggest that this decline in inflation may prompt the Bank of England to accelerate interest rate cuts, leading to a slight decrease in Sonia swaps again, according to Mark Harris, chief executive of SPF Private Clients.