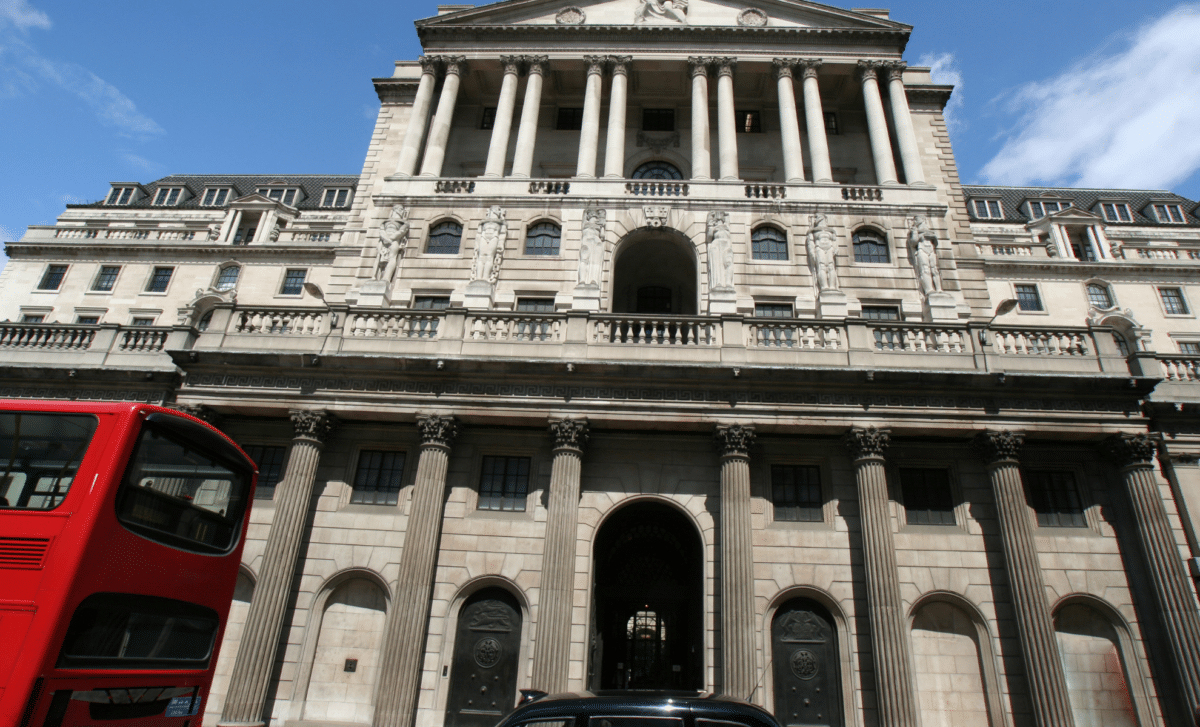

The Bank of England will soon cut interest rates to 3% in a move to support mortgage borrowers as inflation declines sharply, according to senior economists from KPMG.

The Bank of England Hints at Anticipated Rate Cuts Amidst Inflation Decline

Inflation is expected to fall below the bank’s target of 2% in the next couple of months as energy bills plummet.

Yael Selfin, chief economist at KPMG in the UK, warned that if Governor Andrew Bailey and the Monetary Policy Committee are not willing to cut interest rates in the coming months, the country’s economy could suffer harmful consequences.

She highlighted: “If inflation is going to undershoot the target, it is going to be very difficult for the Bank to keep rates higher when it is really not necessary.”

The economy slipped into a brief recession during the last quarter of 2023, and MS Selfin warns the Bank risks over-tightening by maintaining rates at 5.25% instead of easing policy.

Last week, Mr. Bailey hinted that rate cuts are “on the way” as inflation is eventually under control.

KPMG is expecting the economy to make a slow recovery from the recession, with a 3% growth this year and 0.9% next year.

The analysts anticipate that the GDP will grapple with a trend rate of growth of 1% this decade.

Ms. Selfin stated that a decline in immigration will result in a slow growth, as the economy is used to increasing levels of arrivals from overseas, while fragile investment and hindered productivity growth will also impede the long-term perspective.

Business investment is anticipated to fall by 0.1% in 2024, as directors are concerned about the future.

“Demand remains the main source of concern for many businesses as they put hiring decisions on hold and reconsider investment plans,” Ms. Selfin remarked.

“The upcoming general elections, both at home and among the UK’s main trading partners, compound the uncertainty surrounding future tax and trade policies within an already fragile geopolitical landscape.”

Job Market Shows Signs of Recovery Amidst Economic Challenges

Separate data from job hunt engine Adzuna indicates that the job market is displaying signs of recovery.

The number of job opportunities reached 866,242 last month, decreasing by 0.14% from January’s level and a much smaller fall than in previous months.

Vacancies had decreased by 6.64% between December and January and by 6.95% between November and December.

Adzuna said the market seems to be getting better after a complicated start to the year.

The figures indicate a growing confidence among companies in the state of the UK economy. In some fields, including maintenance and the travel industry, the number of positions being advertised was high on January levels, Adzuna declared.

Graduate roles have also climbed by 5.3% on January’s figures, while there were 5.2% additional property positions displayed on Adzuna.