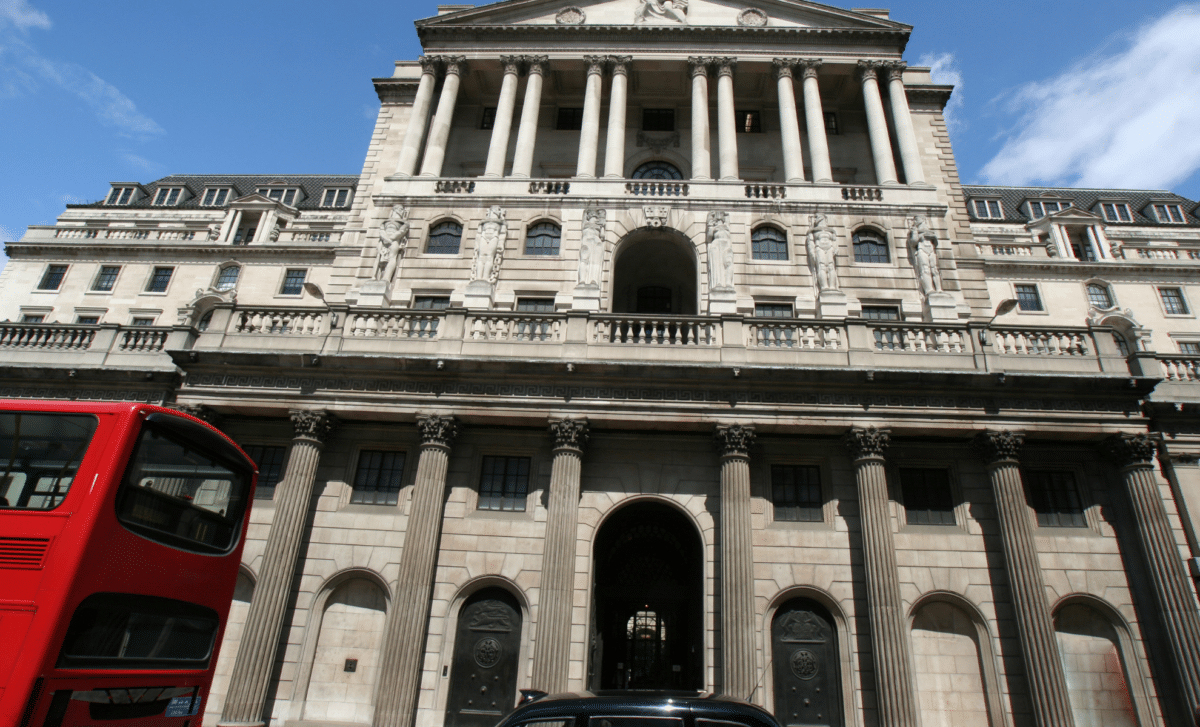

The Bank of England is facing increasing Tory pressure for interest rate reduction ahead of the scheduled May rate-setting meeting, driving economists to caution that politicians should not interfere with the central bank’s independence.

Chancellor’s Rate Cut Rhetoric Sparks Debate Amidst Bank of England’s Internal Struggles

Chancellor Jeremy Hunt has repeatedly mentioned the possibility of cuts as he demands a feelgood element in the economy ahead of the probable election this year.

However, analysts have criticized his loud comments for eroding the distinction between the Treasury and the independent BoE.

Jagjit Chadha, director of the National Institute of Economic and Social Research, cautioned, “This is dangerous territory for politicians to get into,” regarding Hunt’s remarks on rate reduction.

“It is off limits for politicians to talk about what they expect or anticipate for interest rates and to take credit for [falling] inflation. They have handed the job to the Bank and should let them get on with it.”

The political tensions come as the bank’s Monetary Policy Committee struggles with internal disagreements about when to decrease interest rates from 5.25 percent, with members Dave Ramsden and Huw Pill expressing differing views on the continuance of inflation earlier this month.

Faced with a persisting opinion poll deficit, the Conservatives are looking for improved economic conditions to support their re-election campaign.

However, high interest rates threaten the party’s prospects. According to the Resolution Foundation think tank, the 1.5 million homeowners that need to remortgage this year would see their payments jump by an average of £1,800 per year.

In November, Prime Minister Rishi Sunak proclaimed joyfully that his goal of halving inflation had been achieved.

During a visit to the United States this month, Hunt told the Financial Times that markets expected rate cuts in the midsummer or autumn, pointing to a scenario in which “people are going to begin to feel the British economy has really turned a corner — particularly towards the end of the year.”

He stated to the Financial Times in December of last year that there was a “reasonable chance” the BoE would lower interest rates in 2024.

Rate cuts have been specifically demanded by a few Tory MPs. According to former Tory cabinet minister Sir Jacob Rees-Mogg, “I think the Bank ought to have cut rates already.” “On the way down, it is repeating its mistake and was slow on the way up.”

The chief executive of the economic consulting firm Fathom Consulting, Erik Britton, a former official of the Bank of England, stated that the chancellor’s remarks might cause the public to anticipate a rate reduction. “The decision is not the chancellor’s decision, it is the BoE’s decision,” Britton stated.

“It does feel like they are walking up to the line that demarcates operational independence of the BoE and having a really good look over that line — and maybe putting a foot over it to see what it feels like,” he continued.

Bank of England Officials Divided Over Rate Cut Decision Amid Political Pressure

The MPC will next decide rates on May 9. Ramsden, the BoE’s deputy governor, hinted this month that he didn’t need more convincing proof of slowing price growth to vote for a rate cut, citing “downside risks” to the BoE’s February inflation forecast, which predicted that consumer price inflation would fall temporarily before rising later in the year.

But Pill, the bank’s top economist, took a totally different tone on April 23, saying he was “relatively cautious” about commencing rate decreases.

Neville Hill, an economist at Hybrid Economics, a consultancy, stated that the BoE is now “pretty comfortable” with its independence, which was accorded by Labour in 1997, and that he does not expect it to be harmed by political pressure.

The central bank has frequently been targeted politically in recent years, not least because inflation in 2022 reached double-digit levels and infuriated Tory ranks.