In a surprising twist, it’s not the Baby Boomers leading the way in Australia’s property market anymore. As of 2026, Generation X has taken the crown as the wealthiest property owners. But what’s driving this shift, and what does it mean for the younger generations trying to break into the market?

The Great Wealth Transfer: Gen-X Takes the Lead in Property Wealth

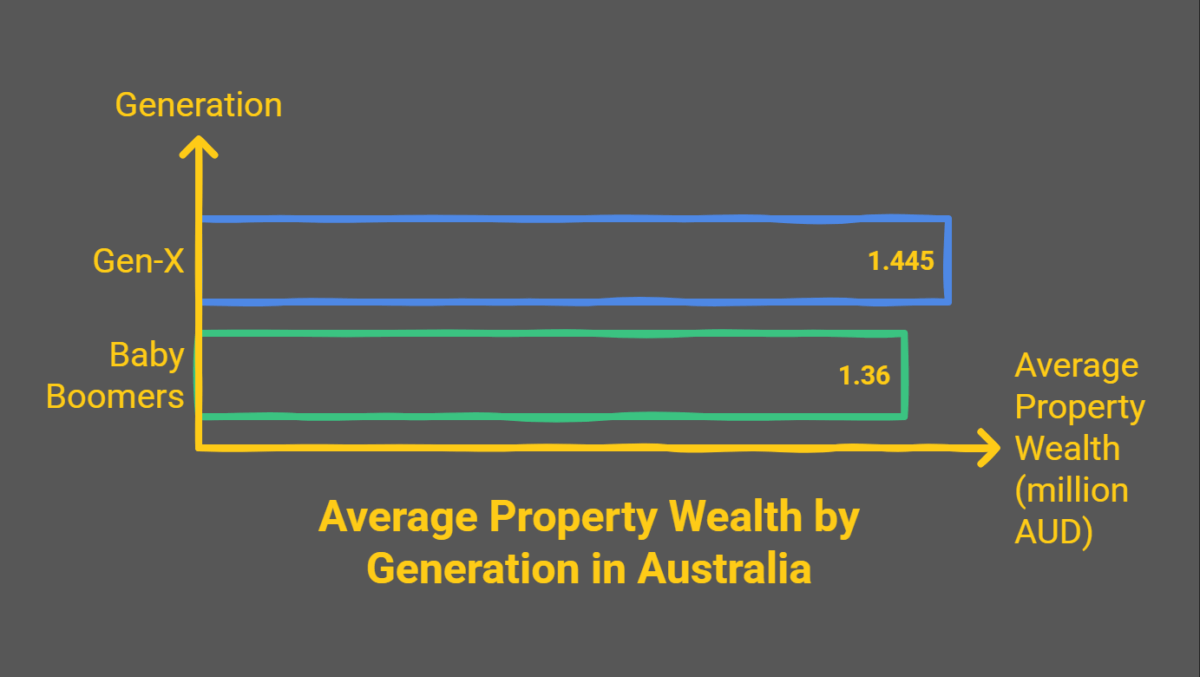

New data from KPMG reveals that Gen-Xers (born between 1965 and 1980) now hold the largest share of wealth in Australian property, with an average of $1.445 million in dwellings and land. This has outpaced Baby Boomers—those aged between 61 and 79—who hold $1.36 million in property. The shift is being called “the great wealth transfer,” as Boomers are beginning to downsize and move their wealth into cash and superannuation accounts.

Interestingly, Gen-Xers are not just accumulating wealth in real estate—they are also leading in share investments, holding more stocks than the Baby Boomers. However, their wealth is often tied up in mortgages, with many still paying off homes. Despite this, they’ve overtaken Boomers in the property space, which has been historically dominated by the older generation.

Millennials Left Behind?

For Millennials, the story is far different. The average property wealth for those aged 29 to 44 is $890,000, a far cry from Gen X’s. In fact, the younger generation’s overall net worth is only slightly higher, at $905,000. When it comes to debt, Millennials are facing steep challenges, with an average of $460,000 owed, much of it tied to mortgages.

Despite their struggles, there’s hope. Millennials have been seeing some relief thanks to a rise in homeownership driven by low interest rates during 2020-2021. However, with interest rates now significantly higher, many feel the dream of homeownership is slipping further out of reach.

Superannuation: The New Wealth Builder

Interestingly, while property ownership remains a key wealth generator, superannuation is becoming increasingly important for younger Australians. With compulsory super contributions growing, younger generations are expected to have more savings when they retire. This could play a crucial role in closing the wealth gap between the generations, particularly for those who are locked out of the property market.

The future is looking complex: as property prices continue to soar, the younger generations may have to rely on alternative assets like stocks and superannuation to build their wealth. But will it be enough to catch up to Gen X’s growing real estate empire?

The Bottom Line

While Gen-Xers have come out on top in property wealth, the road ahead for Millennials remains tough. With the housing market becoming more out of reach and interest rates climbing, there’s no clear path forward for younger Australians. But with superannuation as a growing safety net and a shift toward shares and other investments, the battle for wealth is far from over.