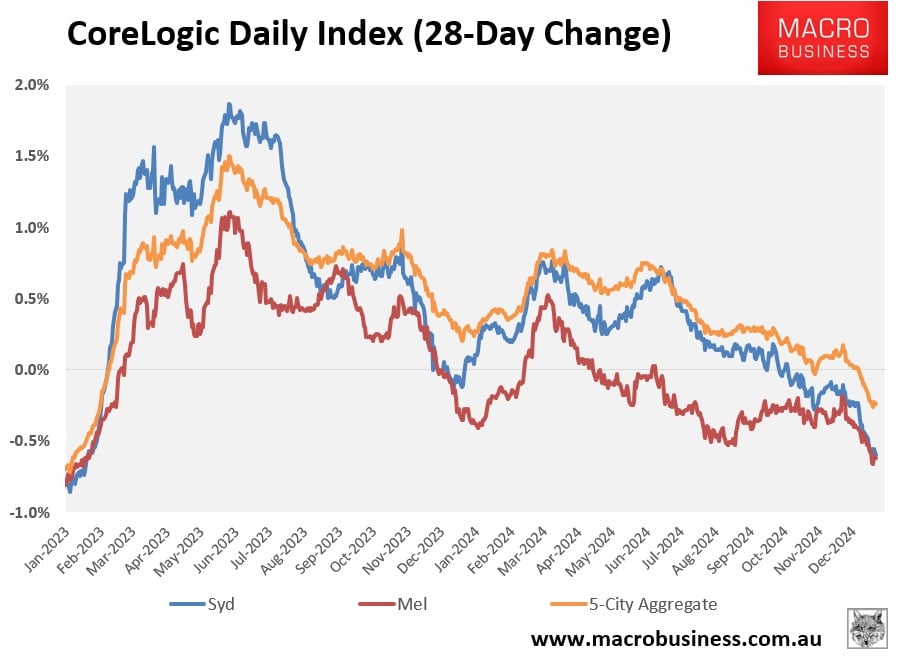

Dwelling values in Sydney and Melbourne have experienced significant declines in 2025, dragging national prices down according to the CoreLogic daily dwelling values index. Over the past 28 days, values in these cities have fallen by 0.6%, contributing to a 0.2% decline in the aggregate value across the nation’s five largest cities.

Falling House Prices Align with Auction Market Weakness

The decline in home values aligns with broader trends in the auction market, where clearance rates have dropped sharply throughout the year. Sydney, in particular, has seen pronounced weakness in this sector, reflecting a cooling demand amid shifting market conditions.

This downturn contrasts with earlier unexpected resilience in the property market. Many analysts and economists, anticipating significant falls in response to the Reserve Bank of Australia‘s (RBA) aggressive interest rate hikes, were initially proven wrong when house prices rose despite reduced borrowing capacity.

Factors Behind the Unexpected Resilience

House prices had remained surprisingly buoyant due to two main factors:

- Unprecedented levels of net overseas migration: A surge in migration created additional demand, particularly in urban centers like Sydney and Melbourne.

- Stock shortages: Limited housing supply contributed to upward pressure on prices, even as interest rate hikes made mortgages more expensive.

These dynamics caused dwelling values to decouple from traditional factors like borrowing capacity, pushing affordability to record lows.

The Shift Toward a Downward Trend

By late 2025, the market began returning to fundamentals. As net overseas migration slowed and housing stock levels rebounded, the relationship between mortgage rates and dwelling values started reasserting itself. Higher interest rates have constrained buyers’ budgets, driving home values lower.

The market’s trajectory indicates that house prices will likely continue to decline unless the RBA cuts interest rates, which would improve borrowing capacity and potentially stimulate demand.

Outlook for 2026

While the downturn in Sydney and Melbourne has grabbed headlines, the broader market faces similar pressures. Slowing migration, increasing stock, and persistent affordability challenges suggest that national housing prices will remain under downward pressure in the near term. The RBA’s future decisions on interest rates will be critical in determining the direction of the market in 2026.