Australia’s living standards are falling, and at the heart of the problem lies a sharp decline in labor productivity, according to AMP chief economist Shane Oliver. His analysis points to stagnating productivity levels as a major driver of the nation’s economic woes, compounded by record-high government spending.

Productivity Slump Puts Australia at the Bottom

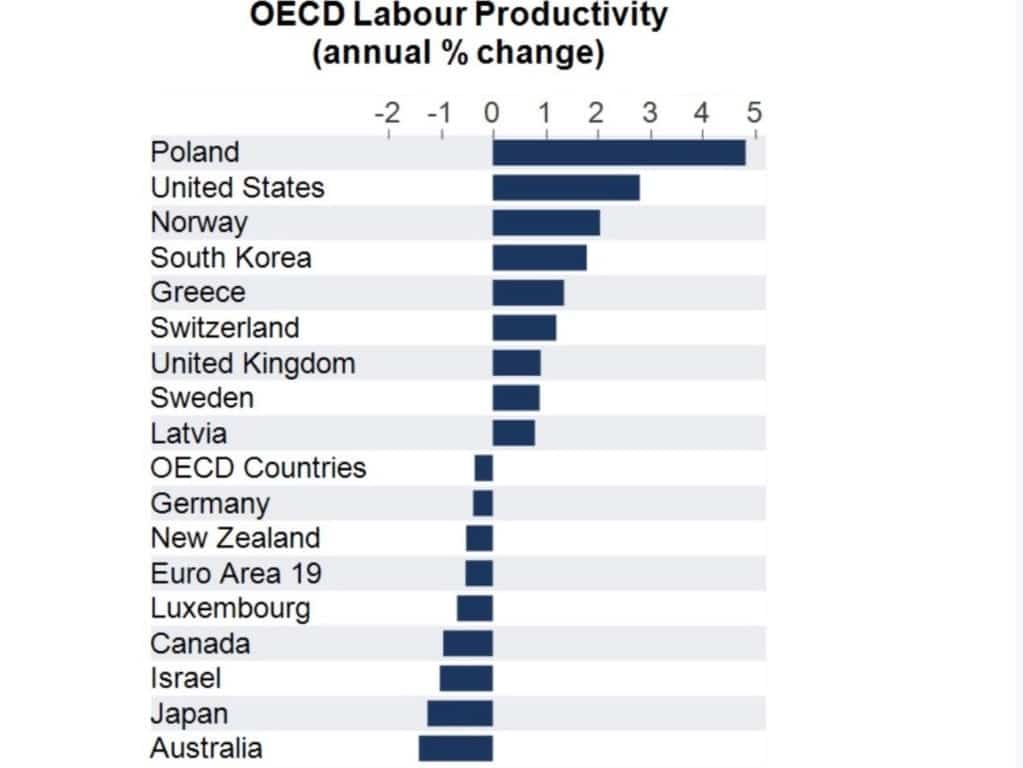

In a recent post on X, Mr. Oliver shared a striking graph comparing annual changes in labor productivity across advanced economies. Australia sits at the bottom of the rankings, with productivity declining by 0.8% over the last year. In contrast, the United States saw nearly 5% growth, and Norway achieved a 2% rise.

Labor productivity measures the amount of goods or services a worker produces in a given time. Higher productivity often translates to increased wages, lower production costs, and more affordable goods and services—key factors that support rising living standards.

“Australian labor productivity growth running at the bottom of the OECD … it’s the basic reason why living standards are falling in Australia,” Mr. Oliver explained.

Government Spending Exacerbates the Issue

The surge in government spending, now at a record 28% of GDP, is a critical factor undermining productivity. Mr. Oliver argues that public sector productivity typically lags behind the private sector, and excessive government expenditure is crowding out private investment, further dragging down productivity.

This dynamic also complicates the Reserve Bank of Australia’s (RBA) efforts to control inflation. Elevated public spending has kept overall demand in the economy higher than it would otherwise be, forcing the RBA to maintain higher interest rates to temper inflation. This has had a cascading effect on private households, which are now cutting back on discretionary spending due to the higher cost of borrowing.

“Households have paid for this by having to cut back their discretionary spending. Were it not for the surge in public spending, inflation would now likely be lower, and so too would the RBA’s cash rate,” he stated.

What Needs to Change

Mr. Oliver emphasizes that reversing Australia’s productivity slump will require politically challenging reforms, including:

- Tax reform: Simplifying and restructuring the tax system to encourage private investment and economic activity.

- Labor market deregulation: Increasing flexibility in hiring, wages, and working conditions to spur innovation and efficiency.

- Competition reforms: Promoting more competitive markets to drive better productivity outcomes.

He also highlighted the importance of government and the RBA working in alignment, particularly as the next federal election looms, which may complicate the implementation of unpopular but necessary policies.