In a bold move to combat card fraud, Mastercard has revealed a new overhaul for the way Australians will pay with their cards. The upcoming changes aim to drastically reduce the $1 billion lost annually to card fraud in Australia.

A New Way to Pay

Traditionally, Australian consumers have relied on a static 16-digit card number to make online or in-person purchases. This system, however, has created a significant vulnerability: once a retailer is hacked, card information—such as the 16-digit number, expiry date, name, address, and CVC code—can be stolen and misused.

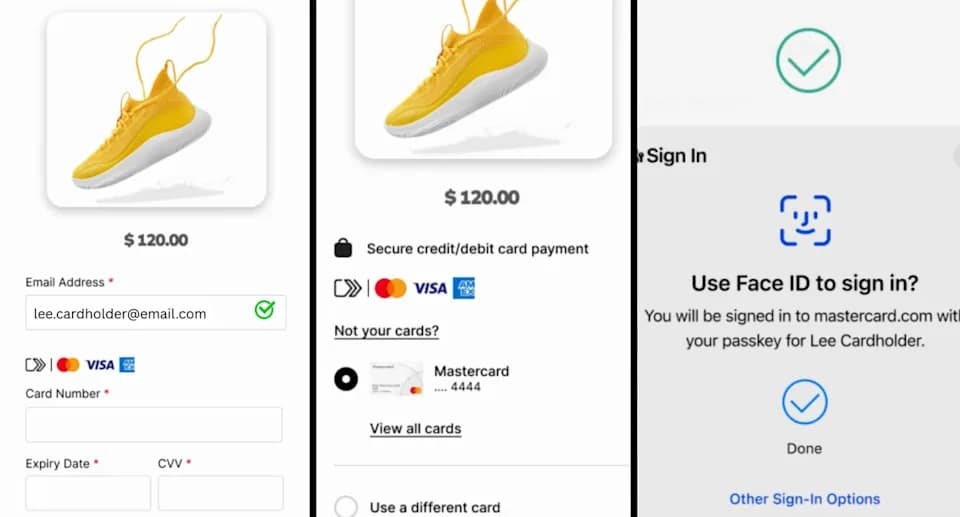

Mastercard’s new overhaul seeks to address this by allowing users to generate new card details for every transaction. By logging into their banking apps, users can obtain a fresh 16-digit card number and CVC code to complete their purchases.

The technology behind this system makes it nearly impossible for fraudsters to use stolen card information, as the card details are unique each time.

Richard Wormald, the president of Mastercard’s Australasia division, explained that this shift from physical cards to more secure, digital payment methods is a “subtle but important change” that is needed as the world increasingly moves away from traditional card payments.

According to Wormald, “We’ve largely shifted away from physical cards, and so we’re quite used to the experience where I get my phone out, I use FaceID to identify myself, and then I just tap and pay.”

Reducing Fraud and Increasing Security

Card fraud is a growing problem in Australia, and Mastercard’s new approach aims to make significant strides in reducing the number of fraud cases.

The system will ensure that even if a user’s card information is stolen in a breach, the fraudster will not be able to use it again, as each set of card details is valid only for one transaction.

This unique, dynamic nature of the new card details will close a major security gap that has long existed in the payment system. The overhaul is designed not just for security, but also for convenience.

Since the system allows users to generate a new set of details from their banking apps, it eliminates the need for the traditional practice of issuing new physical cards every few years.

Wormald suggested that fewer physical cards will be necessary, as more transactions will move to digital platforms, offering an overall smoother and more secure payment experience.

Banks Are Already Adopting the Change

This new system is already being adopted by some banks. AMP, for instance, introduced numberless cards for its small business and personal banking customers back in February.

These cards are linked to the bank’s app-only banking service, which gives users the ability to generate a unique card number directly from the app.

AMP is one of the first to adopt this numberless card approach, and it’s expected that other major banks, including Australia’s Big Four, will follow suit in the near future.

Wormald predicted that the Big Four banks will roll out the new system later this year, helping to ensure that a significant portion of the Australian population will benefit from this innovative payment security overhaul.