The dream of affordable homes in Australia seems to be slipping further away, as new forecasts reveal that home prices in every major capital city will soar past the $1 million mark by the start of 2028. While the future of the housing market remains uncertain, one thing is clear: the cost of buying a home in Australia is set to become even more daunting for average Australians.

Prices to Rise Across All Major Capitals

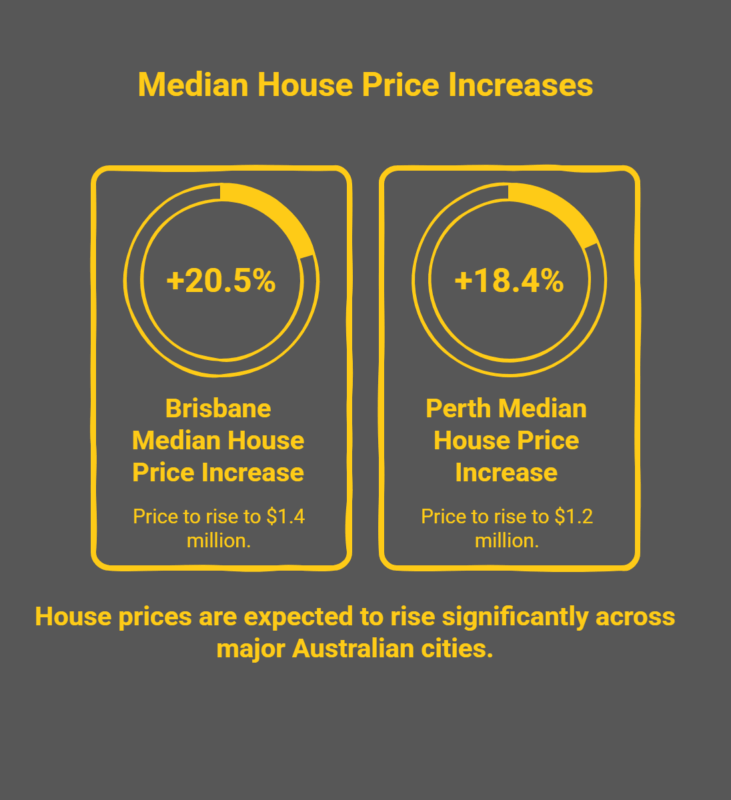

According to recent predictions by KPMG, national home prices are expected to rise by an average of 7.7% in 2026, with some cities, such as Brisbane and Perth, forecast to see even higher growth. For Sydney, already the most expensive city, house prices will continue to climb, albeit at a slower rate, pushing the median house price to $1.81 million by 2028—an increase of $192,000 from 2026 levels.

Other cities are expected to follow suit, with Brisbane leading the charge. Brisbane’s median house price is set to increase by $240,000 over the next two years, bringing it just under the $1.4 million mark. Even Perth, long considered one of the more affordable capitals, will see its median house price rise by $187,000 to $1.2 million by 2028.

Affordability Challenges Mount

While price rises are expected across all capital cities, affordability is becoming an increasingly difficult issue. Cities like Sydney and Melbourne have already surpassed the million-dollar mark, and now other cities, such as Brisbane and Perth, are following suit. This has significant implications for first-time buyers, who are already struggling to keep up with escalating property prices.

One of the driving factors behind this surge in house prices is a significant housing shortage. As KPMG’s chief economist, Dr. Brendan Rynne, explains, housing supply is failing to meet demand, with the gap expected to widen over the next two years, reports Realestate. Even with government schemes like the 5% First Home Guarantee, which aims to make homeownership more accessible, rising prices are pushing the dream of owning a home further out of reach for many Australians.

A Shifting Landscape for Property Investment

These predictions are also raising questions about the future of property investment in Australia. Investors who had once considered buying in Brisbane and Perth may find themselves facing increasing costs as these cities experience price surges similar to those seen in Sydney and Melbourne.

For first-time buyers, the future looks uncertain. With wages lagging behind the rate of property price growth, many Australians are finding it increasingly difficult to enter the housing market. This growing gap between income and housing costs may lead to a larger divide between property owners and renters, with long-term consequences for both the economy and society.

What Does the Future Hold?

The housing market in Australia is clearly entering a new phase. While price growth continues to outpace expectations, the future remains unpredictable. How will Australians navigate this new reality? What steps will be taken to ensure that homeownership remains within reach for those who aspire to own property?

As the market grows more competitive and expensive, it will be interesting to see whether the government introduces new measures to manage the housing crisis or whether Australians will continue to adapt to a rapidly changing property landscape.