The school year hasn’t even started, and many parents are already feeling the financial pinch. New data shows Australian families are sinking further into debt as back-to-school costs pile up.

Families Struggling Under Growing Debt Pressure

The latest figures from Compare the Market reveal that nearly 40% of parents have had to rely on credit cards or buy-now-pay-later services to cover the costs of uniforms, stationery, and school fees this year. The surge in spending comes as living costs continue to outpace wage growth, leaving many families with little room to move financially.

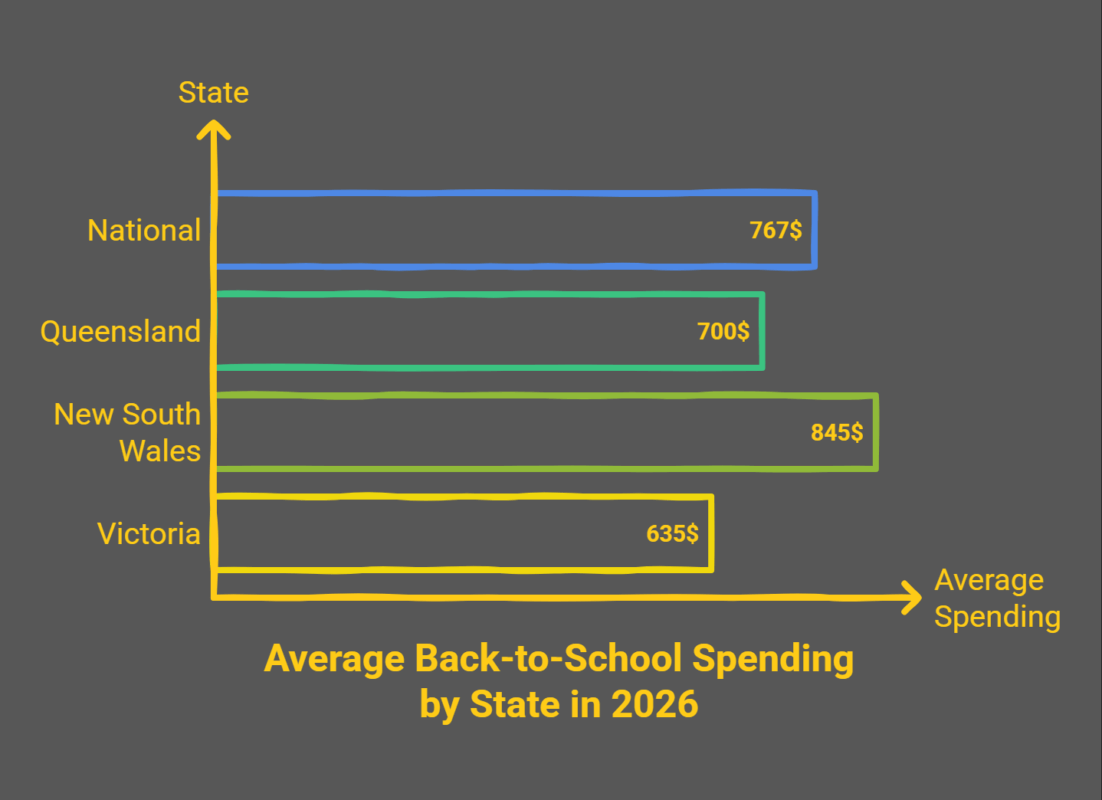

For some households, these annual expenses are now stretching into the thousands. With the average family spending more than $600 per child, it’s no surprise that debt is creeping higher. Financial experts warn that short-term borrowing options, while convenient, can quickly spiral into long-term problems.

Once school supplies and fees are covered, many families face a tough reality — interest charges, repayments, and fewer savings for emergencies, explains Sky News.

Credit Cards and Buy Now, Pay Later Add to Debt Burden

Buy-now-pay-later platforms like Afterpay and Zip have become increasingly popular among parents looking for flexibility, but financial counsellors are sounding the alarm. The rise in small, staggered payments often disguises the total debt being accumulated across multiple purchases.

Meanwhile, the reliance on credit cards continues to climb. Compare the Market’s spokesperson Chris Ford said more families are turning to plastic to manage short-term costs, even as interest rates remain high. For many, that means paying back much more than they initially borrowed.

It’s a worrying sign that, despite some improvements in inflation, household debt remains one of Australia’s biggest financial vulnerabilities heading into 2026.

Rising Costs Across the Board

From new laptops to sports gear, almost every school-related cost has increased. Parents report that even basic stationery items are noticeably more expensive than last year. Energy bills, rent, and fuel prices are adding further strain, making January a particularly challenging month for household budgets.

Some families are cutting corners wherever possible — reusing old supplies, delaying non-essential purchases, or even crowdfunding for school fees. Charities and community groups say they’re seeing more requests for help than ever before.

The Bigger Picture

Economists say Australia’s household debt levels were already among the highest in the world before this latest squeeze. With interest rates still elevated and savings buffers shrinking, families relying on credit to get through the school season could face financial stress later in the year.

For many parents, back-to-school season isn’t about excitement — it’s about survival. And once the textbooks are bought and the lunchboxes packed, the bills will still be waiting.