Australia’s housing market is showing signs of slowing after years of rapid price increases, with affordability constraints limiting further growth. A recent Reuters poll suggests that home prices will rise only modestly in 2025, reflecting the challenges faced by first-time buyers and the broader market.

At the heart of the issue is a persistent housing shortage and a sharp rise in property values over the past five years, making homeownership increasingly unattainable for many Australians.

While interest rate cuts by the Reserve Bank of Australia (RBA) may offer some relief, experts caution that structural issues will continue to weigh on affordability.

Home Prices Expected to Rise, but at a Slower Pace

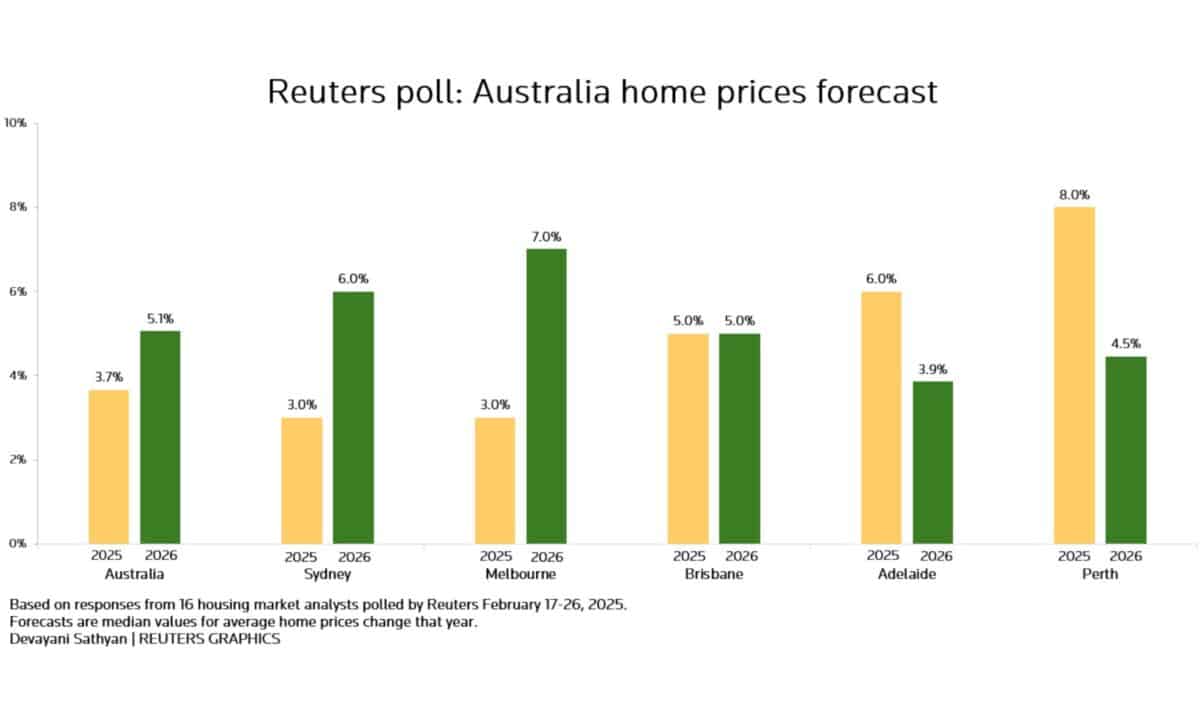

The survey of 16 real estate analysts, conducted between 17 and 26 February, forecasts a 3.7% increase in Australian home prices in 2025, with a higher 5.1% increase in 2026. This marks a slowdown from the 5.0% rise in 2024 and 8.0% in 2023, reflecting affordability constraints and limited purchasing power.

Despite expectations of further interest rate cuts, analysts believe that these will not be enough to ease affordability pressures. The RBA reduced its cash rate to 4.10% in February, with two additional cuts anticipated this year.

However, experts argue that high property prices relative to income levels will keep many prospective buyers out of the market.

“You have to be middle-aged and above-average earning to enter the housing market,” said Johnathan McMenamin from Barrenjoey, highlighting the exclusivity of homeownership in Australia.

“You have to be middle-aged and above-average earning to enter the housing market,” stated Johnathan McMenamin.

Supply Shortage Continues to Drive Market Imbalance

A fundamental driver of the housing market’s challenges is the lack of new housing supply. Property prices have surged more than 40% over the past five years, while construction has struggled to keep up with demand.

This imbalance has placed upward pressure on home values, making it increasingly difficult for younger Australians to buy their first property.

According to CoreLogic, the average asking price for an Australian home reached AUD 814,293 in February, nearly eight times the average annual income. In Sydney, where housing costs are among the highest, prices averaged AUD 1,193,228, making homeownership even more difficult.

In major cities, the strain on supply is expected to contribute to varying levels of price increases. Sydney home prices are forecast to rise 3.0% in 2025, with a more pronounced 6.0% increase in 2026, while Melbourne is expected to see similar trends, with 3.0% growth in 2025 followed by 7.0% in 2026.

“The main support for house prices in Australia since the 2000s is an imbalance between supply and demand… That is definitely a structural issue that will take pretty long to solve,” said My Bui, an economist at AMP.

Regional Markets Show Stronger Growth

While price growth is slowing nationwide, some regional markets are expected to see stronger gains. Mid-sized capital cities such as Brisbane, Adelaide, and Perth experienced price increases of 10-20% in 2024, and analysts predict further 5.0-8.0% growth in these markets.

Brisbane home prices are forecast to rise 5.0% in both 2025 and 2026, showing steady growth. Adelaide, where demand has been particularly strong, is projected to experience a 6.0% increase in 2025, followed by the same level of growth in 2026. Perth, which saw some of the highest gains last year, is expected to rise by 8.0% in 2025, before slowing to 4.5% in 2026.

By contrast, Sydney and Melbourne—historically Australia’s most expensive housing markets—are set for more modest 3.0% increases in 2025, before picking up momentum in 2026. These cities have seen a cooling in demand as affordability constraints take hold.

Housing Affordability Becomes a Key Election Issue

With affordability concerns growing, housing policy is expected to be a major issue in Australia’s upcoming election. Both major political parties are under pressure to address rising property prices, rental shortages, and homeownership challenges.

Despite this, opinions remain divided on whether affordability will improve in the coming year. While seven respondents in the Reuters poll expect conditions to improve, three believe they will deteriorate further.

“If you compare affordability say a few months before to now, then we actually do expect it to improve for most home buyers in Australia. But… we will still continue to see a gap between price and capacity to pay given how much home prices increased over the past few years,” Bui added.

With ongoing supply constraints and high price-to-income ratios, the outlook for first-time buyers remains uncertain. As policymakers grapple with these challenges, the trajectory of Australia’s housing market will be closely watched in the months ahead.