Macquarie Bank’s decision to reduce fixed rates underscores a competitive shift in the Australian mortgage market, influenced by economic speculation and borrower behavior. The following details provide a broader context to the rate changes and their potential implications.

Lender Positioning and the Fixed-Rate Market

Macquarie Bank has positioned itself as a competitive player among smaller and mid-tier lenders, challenging the dominance of the big four banks. By cutting fixed rates, Macquarie aligns its offerings with those of other smaller lenders such as Easy Street, Bank Victoria, and Community First Bank, which have historically attracted cost-conscious borrowers.

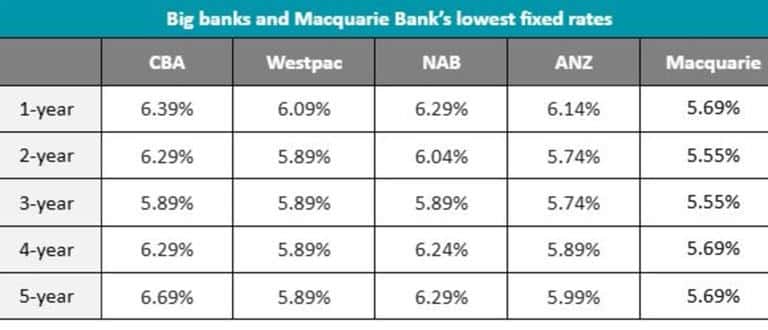

However, even with its adjustments, Macquarie remains slightly behind the market leaders in the two- and three-year fixed-rate segments. For example:

- Easy Street, Bank Victoria, and Community First Bank offer two-year fixed rates at 5.49%, undercutting Macquarie’s 5.55% rate.

- SWSbank offers the lowest three-year fixed rate on the market at 4.99%, compared to Macquarie’s 5.55%.

These variations highlight the nuanced competition among lenders, as each seeks to balance affordability with profitability.

RBA Cash-Rate Decisions and Market Influence

Macquarie’s rate reductions come amid heightened speculation about potential cash-rate cuts by the Reserve Bank of Australia (RBA). The RBA’s decision, scheduled for February 18, is expected to influence lender strategies and borrower preferences in the coming months.

- Fixed rates are typically more reflective of wholesale funding costs rather than immediate changes in cash rates. However, the possibility of future rate cuts is pushing lenders to reevaluate their pricing strategies to maintain competitiveness.

- Sally Tindall, from Canstar, suggests that Macquarie’s move could signal broader shifts in the fixed-rate market: “The prospect of cash-rate cuts in the next few months is likely to encourage more lenders to take the knife to their fixed rates.”

Borrower Sentiment and Decision-Making

Borrower sentiment plays a crucial role in the uptake of fixed-rate products. Many Australians may hesitate to lock in fixed rates now, anticipating further reductions tied to potential cash-rate cuts. This hesitation may limit the immediate impact of Macquarie’s changes, as borrowers weigh the benefits of fixed versus variable rates.

Key considerations for borrowers include:

- Locking in certainty: Fixed rates provide stability and predictability, which can be appealing in times of economic uncertainty.

- Flexibility in a falling rate environment: Variable rates may allow borrowers to take advantage of future cash-rate cuts, which could further reduce interest expenses.

Implications for the Mortgage Market

Macquarie’s fixed-rate cuts are part of a broader trend of dynamic adjustments in the Australian mortgage market. Over the past year, fixed rates have experienced fluctuations driven by changes in funding costs and economic outlooks.

- During December 2024, many lenders increased fixed rates, reflecting higher wholesale funding costs and concerns about inflation.

- The summer slowdown in fixed-rate changes, as noted by industry experts, may now give way to increased activity as lenders adjust their offerings ahead of the RBA’s February meeting.

Macquarie’s changes signal a renewed effort to attract borrowers by offering competitive pricing. This could trigger a rate-cutting cycle among other lenders, particularly if the RBA signals an easing of monetary policy.

What’s Next for Borrowers?

Borrowers evaluating their options should consider the following:

- Market monitoring: Rates are likely to remain dynamic, with adjustments from multiple lenders expected in the coming weeks.

- Borrower profiles: The competitiveness of fixed rates may vary depending on factors like deposit size, loan term, and lender preferences.

- Long-term strategy: Locking in a fixed rate now could provide stability, but flexibility may be limited if rates fall further.

Borrowers should stay informed and consider professional advice to navigate these changes effectively.