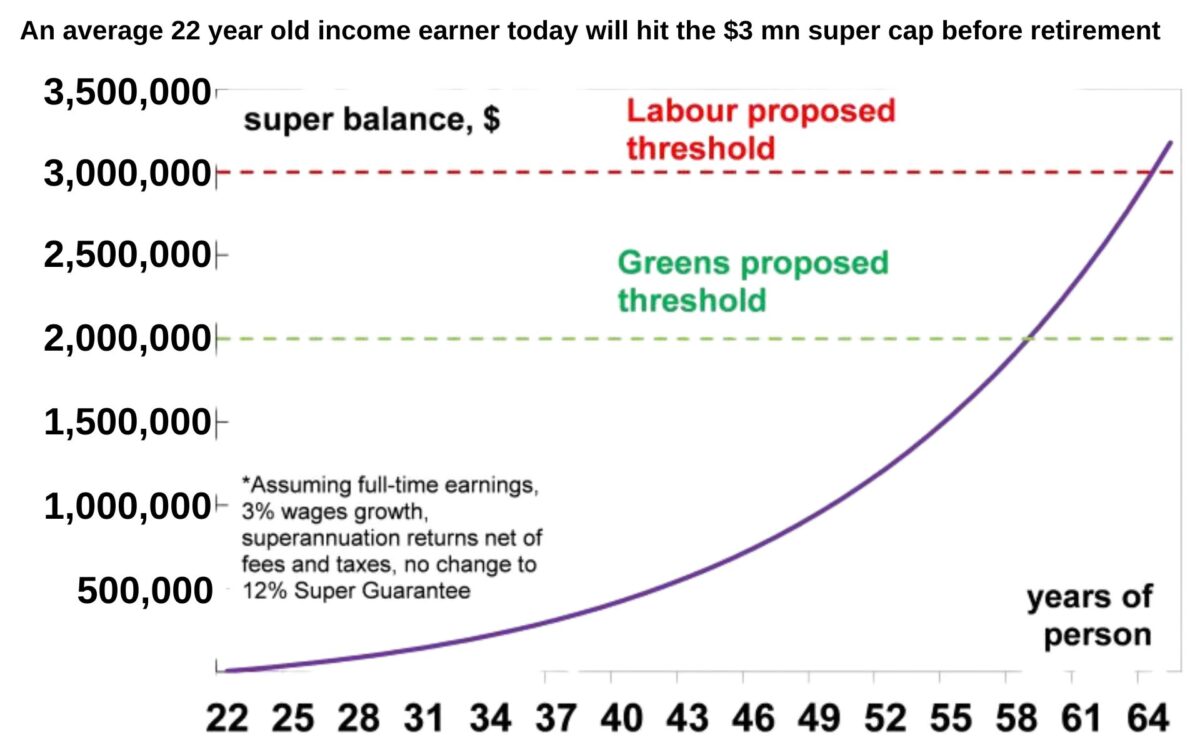

New economic modelling projects that Australians entering the workforce today at age 22 could retire with super balances of $3 million or more, based on assumptions about wage growth, compound interest, and consistent superannuation contributions over their careers.

According to reporting by news.com.au, this scenario is no longer limited to high-income earners, but could become the norm unless government thresholds are adjusted.

The findings raise significant questions about how retirement will be taxed in the decades ahead, the fairness of current policy settings, and whether the government’s modelling and tax thresholds account for the long-term impact of inflation on retirement savings.

Compound Interest and Income Growth Forecast to Drive Super Balances Above $3 Million

According to Diana Mousina, AMP Capital’s deputy chief economist, an average-income earner entering the workforce today and making regular contributions to their super could breach the $3 million cap without any deliberate wealth-building strategy.

An average 22 year old today earning average wages for the rest of their life will breach the $3 million limit unless the government indexes the threshold – Mousina wrote in her note.

The modelling was based on an average annual income of $98,000, 3% wage growth, and 12% employer superannuation contributions.

Mousina clarified that she did not use AMP’s calculator or any public simulation tools, which typically use today’s dollars and fail to factor in future inflation. Instead, she applied a tailored inflation-adjusted model to estimate actual outcomes in future-value terms.

Taxation Change May Affect More Australians Than Expected

The Labor government announced in 2023 its plan to apply a 30% tax rate to superannuation balances over $3 million, up from the existing 15%. At the time, Treasurer Jim Chalmers stated that the policy would only affect about 0.5% of the population, or roughly 80,000 individuals.

But Mousina warned this framing could mislead younger Australians:

Do you think that the proposed $3 million superannuation cap tax won’t impact you because the Labor government said it only impacts 0.5% of people now? Think again!

She emphasized that compound interest significantly alters long-term projections:

I knew that for a high-income earner, $3 million by retirement was something that they would easily hit by retirement because people often forget the impact of compound interest. What did surprise me was that even for an average income earner who is saving right now, they will hit the cap before retirement.

Mousina highlighted the core issue: the absence of inflation indexation in the proposed tax structure.

The policy, as it stands, is trying to target wealth, and I’m not necessarily against that … but it just doesn’t make sense not to index the brackets – she told The Australian Financial Review.

A $3 million balance in 40 years’ time is not the same $3 million balance that you have today. It doesn’t affect 0.5 per cent of the population, it impacts a much higher share.

Alternative Political Proposals and Inflation Indexing

While Labor maintains its stance against indexation, the Greens have proposed a more aggressive measure: lowering the cap to $2 million but indexing it to inflation. This approach would address concerns around long-term bracket creep while maintaining progressive tax principles.

Mousina and other critics argue that failure to adjust the threshold over time distorts the original intention of targeting only ultra-wealthy super balances.

Actual Retirement Needs Far Below $3 Million

In contrast to these high-end projections, Super Consumers Australia, a consumer advocacy group, argues that most retirees need far less to maintain a comfortable lifestyle.

Their January 2024 report found that a single person requires around $310,000, and a couple about $420,000, to sustain medium-spending levels in retirement. These estimates are based on actual spending patterns rather than aspirational goals and assume retirees own their homes and receive the aged pension.

Xavier O’Halloran, CEO of Super Consumers Australia, said this combination allows retirees to spend between $43,000 and $62,000 a year until age 90.