The Australian housing market is showing signs of a significant shift, with home values slipping in key cities and buyers regaining leverage. Sydney, Melbourne, and now Brisbane are seeing declines in property prices, as rising stock levels and weakening demand tip the balance in favor of buyers.

Home Values Retreat in Sydney and Melbourne

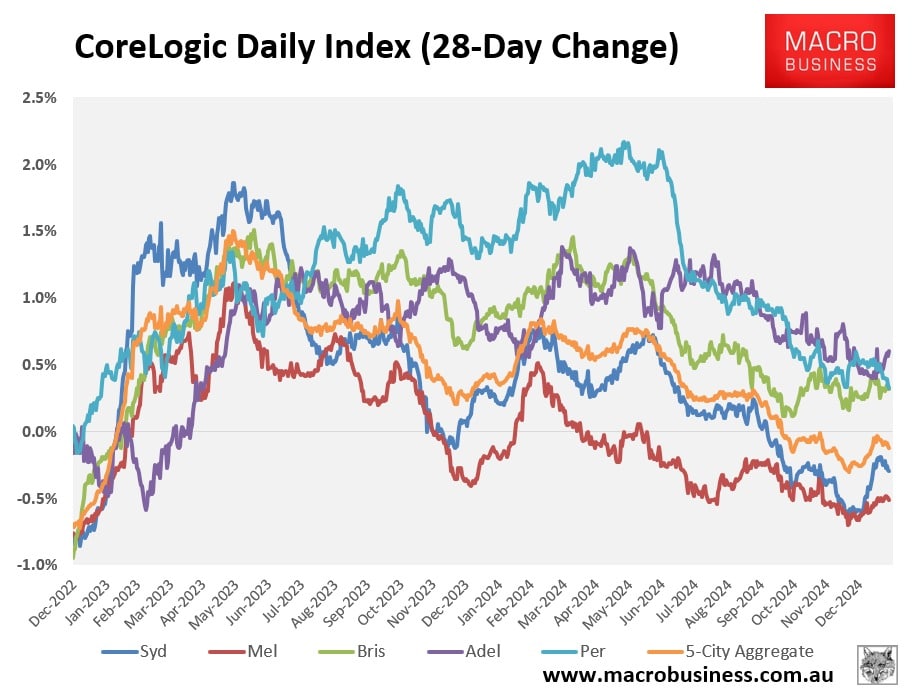

According to CoreLogic’s daily dwelling values index, property values in Sydney and Melbourne continue to slide, dropping 0.3% and 0.5% over the past 28 days. This downward trend is fueled by a surge in new listings—6.7% higher in Sydney and 1.1% higher in Melbourne compared to the same period last year.

While seasonal trends usually dictate a slow start to the year, CoreLogic’s Eliza Owen warns that this downturn runs deeper.

“There’s less appetite from buyers, but more sellers are coming into the market, which could indicate rising mortgage stress,” Owen said.

With interest rates remaining high and signs of a loosening labor market, more sellers may be forced to drop asking prices to secure deals.

Brisbane’s Momentum Slows, Turning Into a Buyer’s Market

Brisbane, a city that has boomed since the pandemic, is now losing steam. Over the past 28 days, dwelling values grew by just 0.3%, mirroring the slower pace seen in Perth.

Buyer’s agent Zoran Solano sees the shift as a win for buyers, noting that many sellers are struggling to meet price expectations.

“For me as a buyer’s agent, it’s a positive sign that the power has shifted back a little bit towards buyers.”

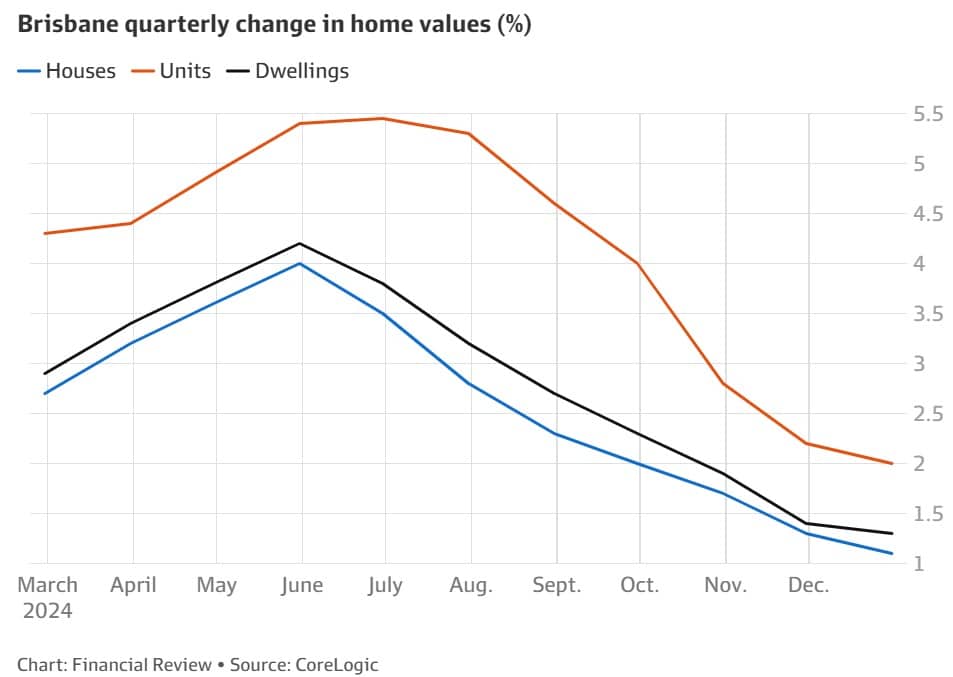

The Australian Financial Review reports that property values are falling in one in seven Brisbane suburbs—the highest rate of decline in almost two years. CoreLogic’s Tim Lawless points to increased listings and slowing interstate migration as key factors reducing demand.

AMP chief economist Shane Oliver predicts that Brisbane could be next in line for price declines, following Sydney and Melbourne’s trajectory.

“Brisbane looks to me like a really soggy market, and I wouldn’t be surprised if house prices go negative in the next couple of months.”

Interest Rates: The Wildcard in Housing Prices

With housing markets softening, the Reserve Bank of Australia’s next move could be crucial. Some experts believe that an interest rate cut could stabilize property prices, preventing further drops.

“A rate cut could turn that downward momentum around,” Oliver said. “If it occurs in February, it has the potential to head off a dip into negative territory for Brisbane prices.”

However, if rate cuts are delayed until April or May, Brisbane could experience further price declines before a potential rebound.

Brisbane’s Rise and Affordability Squeeze

Since March 2020, Brisbane’s home values have surged by 80%, making it Australia’s second most expensive housing market by median value. But rapid price growth has also eroded affordability, reducing buyer demand and setting the stage for a market correction.