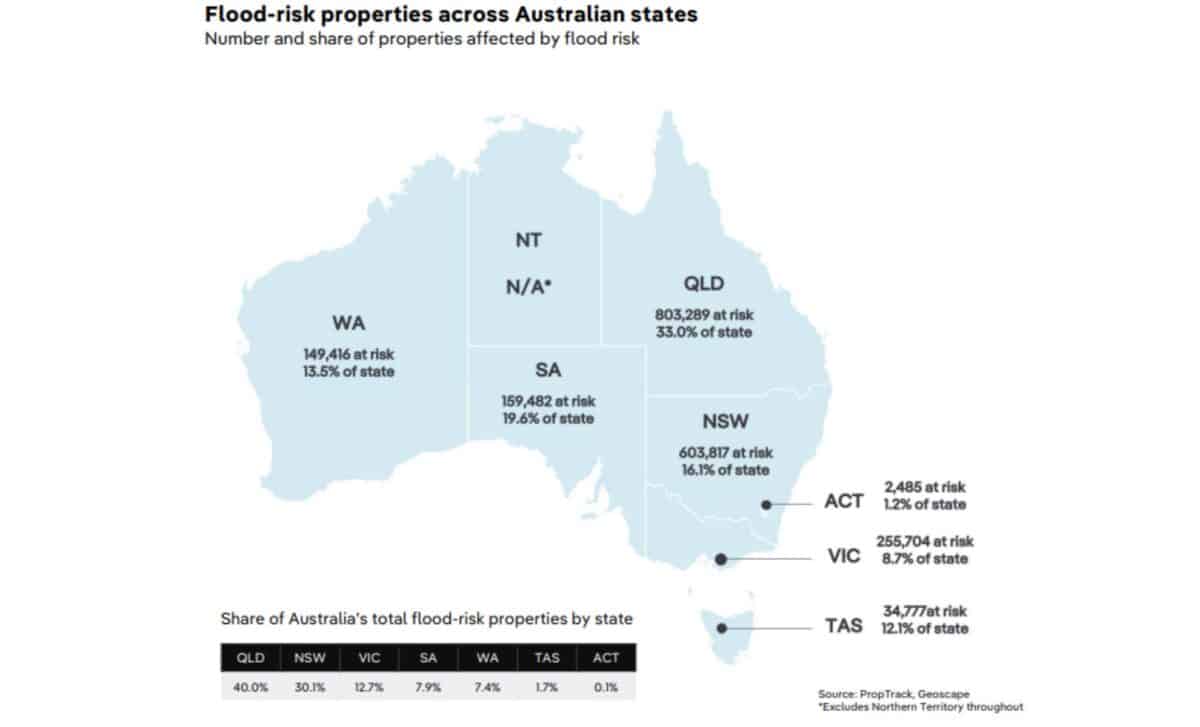

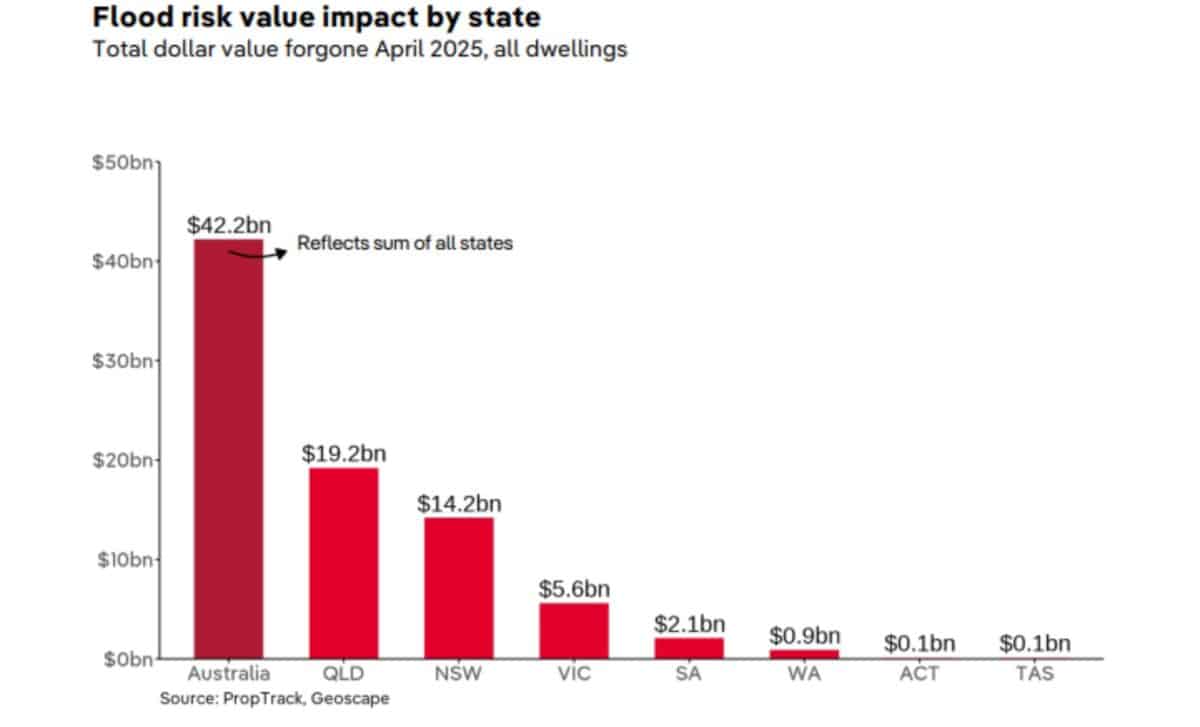

Homeowners in flood-prone areas across Australia are facing a growing financial burden, with a staggering $42.2 billion wiped off the value of properties in at-risk regions. New data from the Climate Council and PropTrack highlights the impact of increasingly severe flooding events, revealing that properties in vulnerable areas are worth significantly less than those in safer zones. With climate change escalating flood risks, this ongoing devaluation is exacerbating inequalities and could shape the future of the housing market.

The report underscores that, while house prices in general have seen growth, homes in flood zones are lagging behind, with some regions experiencing substantial losses. This shifting property landscape raises concerns about the economic repercussions of climate change, particularly for lower-income households who are often most affected by these environmental risks.

A Growing Cost: $42 Billion Lost in Property Value

According to the Climate Council and PropTrack, approximately 70% of properties in flood-prone zones have experienced a devaluation due to climate risks, with the median price of a three-bedroom home in these areas now $75,000 lower than its flood-free counterpart. Over the last two decades, the cumulative impact of repeated flooding events has been particularly felt in states like Queensland and New South Wales, which account for the largest portion of at-risk properties.

In regions like Brisbane, which has experienced multiple floods since 2010, some suburbs saw their property values drop by more than 10%. Homes near the Brisbane River, such as those in Chelmer and Graceville, lost over $300,000 in value, reflecting the growing unease of potential buyers about flood risks. As flood events become more frequent and severe, the long-term economic costs continue to mount, with the report noting that flood-prone homes are increasingly undervalued compared to their safer counterparts.

The Human Toll: Climate Change and Inequality

The impact of this devaluation extends beyond financial losses. Many of the affected properties are owned by low-income families, for whom relocating or insuring their homes is not always an option. Nicki Hutley, an economist and co-author of the report, stated that climate risks are exacerbating intergenerational inequality, as those living in flood-prone areas often have no choice but to accept the risks.

In places like Lismore, which was severely flooded in 2022, residents are feeling the long-term financial impact. Some, like Kate Smolders from Brisbane, have been forced to sell their homes at a loss after enduring repeated flooding. These personal stories highlight the broader issue: the market’s failure to fully account for climate risks is leaving vulnerable communities at a disadvantage, both emotionally and financially.

This complex issue calls for a comprehensive adaptation strategy, including more robust planning laws to limit development in high-risk areas and stronger climate policies to mitigate the ongoing environmental changes driving the property devaluation.