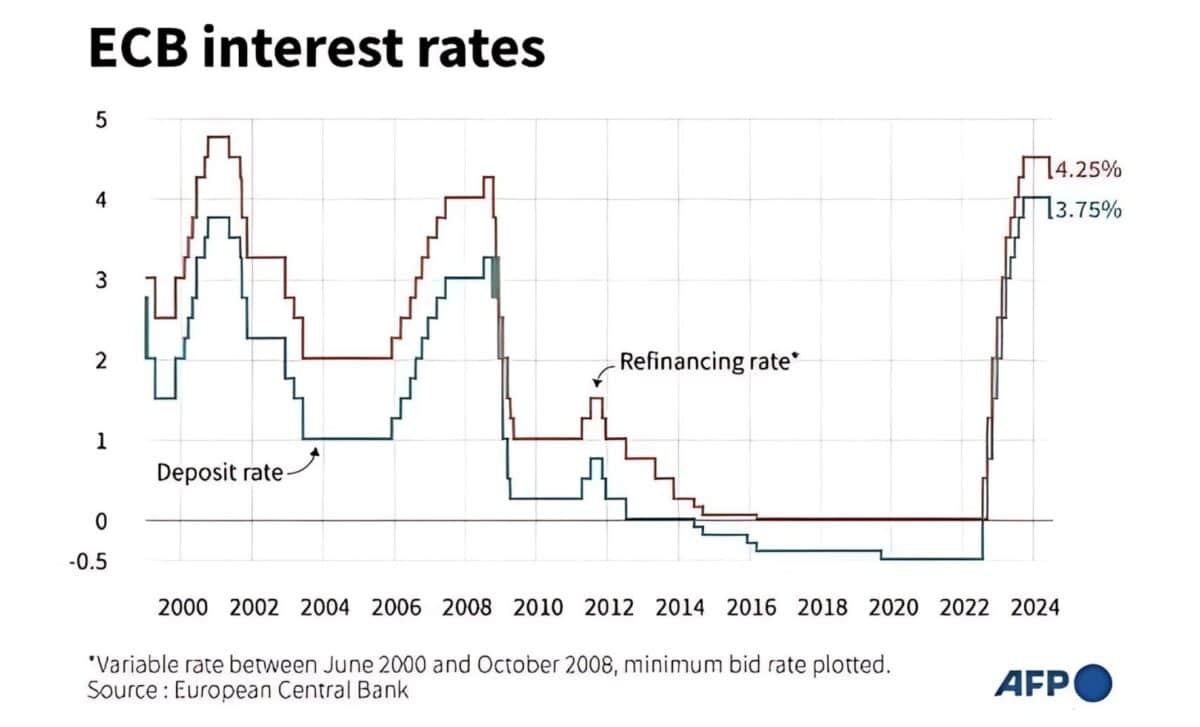

The European Central Bank (ECB) has implemented its second interest rate cut of the year, reducing its main rate to 3.5% from 3.75%. This decision follows a widely expected 25 basis point reduction after the ECB’s first-rate cut in June, which marked its first such move in five years. Alongside the rate cut, the ECB also revised down its economic growth forecasts for the eurozone.

Economic Outlook Remains Challenging

ECB President Christine Lagarde acknowledged that the eurozone’s economic recovery is encountering challenges. She noted that “survey indicators” suggest headwinds are hampering progress, but expressed optimism about future growth: “We expect the recovery to strengthen over time, as rising real incomes allow households to consume more.”

Lagarde also cautioned that risks to growth remain skewed to the downside, citing potential declines in global demand and ongoing trade tensions as significant threats to the eurozone’s economic health. Weaker demand for euro-area exports, exacerbated by a fragile global economy or increased trade disputes, could further weigh on growth.

ECB Growth and Inflation Projections Revised

The ECB now expects the eurozone economy to grow by 0.8% in 2024, 1.3% in 2025, and 1.5% in 2026. These figures represent slight downgrades from the bank’s June projections, primarily due to weaker domestic demand expected in the coming quarters.

Inflation forecasts remained stable compared to the earlier outlook. Headline inflation is predicted to average 2.5% in 2024, 2.2% in 2025, and 1.9% in 2026, aligning closely with the ECB’s June projections.

Slower Growth, Cooling Inflation

Recent economic data indicates a softening eurozone economy. Eurostat revised the region’s second-quarter growth from 0.3% to 0.2%. Additionally, Germany, the eurozone’s largest economy, reported a 2.4% drop in industrial production for July, intensifying pressure on the ECB to implement policies supportive of growth.

At the same time, inflation is showing signs of easing. Eurozone inflation fell to 2.2% in August, its lowest level since July 2021, approaching the ECB’s target of 2%. This development has increased expectations of further rate cuts.

The latest rate cut aims to alleviate financial strain on consumers and businesses, which could support an economic rebound across the continent. Lindsay James, investment strategist at Quilter Investors, commented, “Today’s news is sure to provide some relief to consumers and businesses, which could help the continent on its way towards an improved economic recovery.”

However, it remains uncertain whether the ECB will lower rates again this year, as much depends on economic data in the coming months.

Both the U.S. Federal Reserve and the Bank of England (BoE) are set to announce their interest rate decisions next week. The Fed is expected to reduce rates by 25 basis points, maintaining a range between 5.25% and 5.5%.

Meanwhile, markets predict that the BoE will keep rates steady next Thursday, following an August cut to 5%, although additional reductions are anticipated before the year’s end.