Banks are increasing mortgage rates at the same time as reducing savings offers, regardless of the central bank’s interest rate freeze, which has persisted for several months.

Many lenders have increased their mortgage interest rates over the past week, including Virgin, HSBC, Leeds Building Society, Skipton Building Society and other lenders. As a result, the average percentage of mortgages has risen back up to almost 6%, having fallen previously.

In August last year, the BoE froze central bank interest rates; however, top savings offers fell by almost a percentage point. Interestingly, in November, average rates on notice accounts fell from 4.31% to 4.27%, while average rates on easy-access savings accounts fell from 3.19% to 3.11%.

Impact of Soaring Mortgage Rates and Falling Savings Costs

Last summer, National Savings & Investment’s 6.2% bond was the high point of the market, but since then the highest rates have fallen to 4.50% for a four-year bond and 5.25% for a one-year bond.

According to analysis by the Telegraph, savers who chose the big banks over the best-performing accounts would have lost interest of £318 last year.

Meanwhile, research by the Liberal Democrats predicts that an average of 4,200 mortgage holders will see their monthly payments rise by £240 every day between now and November when they switch to higher rates on a new mortgage.

The banks’ independent rate-setting practices have been criticised by financial experts such as Sarah Coles and Rachel Springall. They have been accused of taking advantage of customer inertia and failing to keep up with wider economic trends, such as Bank of England rate changes.

“Most of their rates tend to be well below those of the market leaders,” said Sarah Coles. Because savings money is so glued together, many savers won’t budge even in the face of disappointing rates, so banks don’t need to compete so fiercely.

Regulatory scrutiny of the way banks set interest rates has raised concerns that they prioritise profits over meeting their customers’ needs.

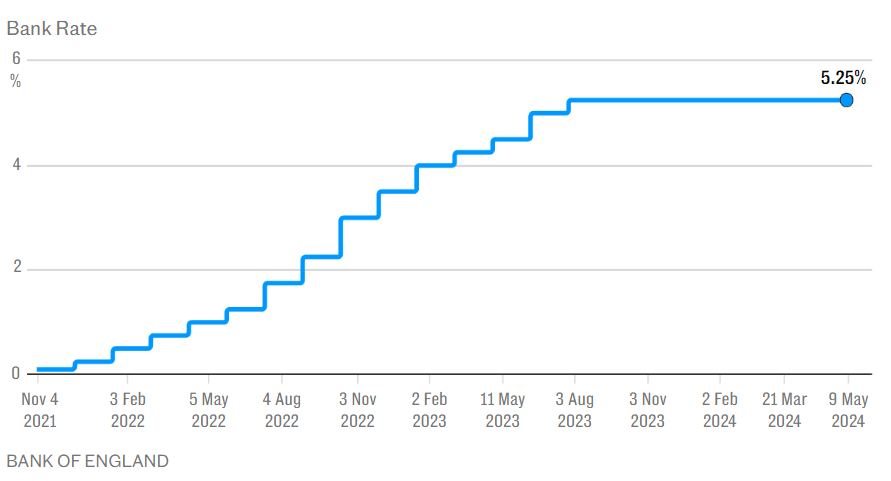

Since last August, the Bank Rate, set by the Bank of England’s Monetary Policy Committee (MPC), which met this morning, has been fixed at 5.25%.

Ms Baldwin told the Telegraph: “Although the Bank of England has not changed rates today, mortgages could, and banks need to make sure they treat mortgage and savings account holders fairly or more customers will leave.

Advocates such as Anna Bowes say it is important that all customers are treated fairly, even though banks often rely on operating costs and market dynamics to make their decisions. This is particularly true of savings rates and mortgage rates.

“There is Fierce opposition with inside the loan market, and a variety of factors, such as shifts in lenders’ funding costs, influence mortgage rates. Currently, fixed rate mortgages make up the majority of mortgages in the UK”

Your blog is a true hidden gem on the internet. Your thoughtful analysis and engaging writing style set you apart from the crowd. Keep up the excellent work!