In a landmark move for the cryptocurrency industry, Mt. Gox, once a titan of Bitcoin exchanges, has begun reimbursing its creditors, turning a new page in one of the most dramatic chapters in the history of digital finance. This significant step follows the notorious 2014 hack that led to the platform’s collapse.

Mt. Gox: From Magic the Gathering to the Giant’s Collapse

Mt. Gox, established as in 2010, was a dominant force in the early cryptocurrency exchange market. In 2014, the platform suffered a catastrophic security breach leading to the loss of 744,408 bitcoins, then valued at approximately $450 million, now valued at the staggering amount of 29 billion USD.

This monumental cyber heist, which unfolded primarily between 2011 and 2014, was centered at Mt. Gox’s operations in Japan. The fallout from Mt. Gox’s demise was immediate and severe. The Bitcoin price, stable at around $1,000 in January 2014, plummeted to about $200 in the days following the collapse.

The Mt. Gox saga has been a focal point in discussions about cryptocurrency security and regulation, and has led to significant security enhancements across cryptocurrency exchanges, influencing the regulatory discourse surrounding digital assets globally.

Post-hack investigations led to the recovery of a significant portion of the lost bitcoins. Down the line, the breach was attributed to sophisticated cyberattacks by individuals who managed to infiltrate the exchange’s digital wallets. In June 2023, bitcoin.fr reported that the U.S. Department of Justice identified the perpetrators as Russian nationals Alexey Bilyuchenko and Aleksandr Verner.

The responsibility for these recovered assets and the liquidation process fell to Nobuaki Kobayashi, the Japanese lawyer overseeing Mt. Gox’s bankruptcy proceedings.

Mt. Gox on the Road to Repayment

Following the 2014 incident, Mt. Gox declared bankruptcy, leaving thousands of investors in disarray. In June 2021, a rehabilitation plan was approved, with a deadline extended to October 2024.

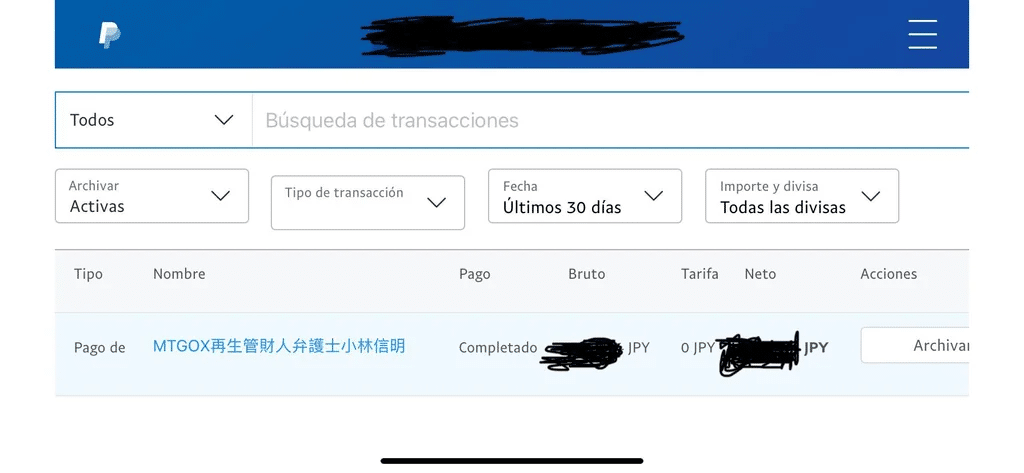

As reported by French cryptocurrency news channel Crypto Subspace Daily News on December 26, repayments have begun, with some users confirming receipt of funds in yens via PayPal, while others await bank transfers. The channel further explains that the repayment process has stirred the cryptocurrency market, with UBS analysts suggesting a potential, albeit limited, impact on Bitcoin prices.

On the Mt. Gox Solvency forum on Reddit, users have begun to share their personal experiences with the repayment process. Evidenced by screenshots of PayPal transactions, these posts offer a glimpse into the realities of receiving long-awaited funds.

One user details their experience, providing insight into the communication from Mt. Gox and PayPal, and expressing queries about the handling of different forms of reimbursement. This particular individual opted for an early lump sum payment in cash, which was successfully received, but also holds expectations for a separate Bitcoin payment, reflecting how Mt. Gox is managing this complex reimbursement endeavor.

Double-Payment Snafu in Mt. Gox Repayment Process

In a curious twist to the ongoing Mt. Gox repayment saga, several users on Reddit’s Mt. Gox Solvency forum have reported on December 27, 2023, receiving double payments due to a system error.

One post shared an official communication from the Rehabilitation Trustee, which clarified that the extra transfer was an error and provided detailed steps for users to return the mistakenly transferred funds. The email, with the subject “[URGENT REQUEST] [MTGOX] Notice of Duplicate PayPal Transfer and Request for Refund,” has sparked diverse reactions among the recipients.

A Reddit user emphasized the legal implications of retaining funds not rightfully owned, urging others to return the extra payment, especially to ensure the continuity of their Bitcoin repayments. Another Redditor, in a seemingly trolling manner, mocked the situation by demanding extensive verification procedures before returning the funds—a KYC, bank details, and a picture of Mt. Gox’s lawyer holding a piece of paper with his name and date from two different angles.—The user is also satirically suggesting a 10-year timeframe for the refund.

A more serious analysis, by another Reddit user, pointed out the potential long-term financial losses for those considering keeping the double payment. /u/ValdemarrPlanB explained that, as the payments received were only a portion of the total expected repayment, keeping the double payment could, in fact, result in a lower overall return. The post urged creditors to be prudent and return the extra funds to avoid complications or reductions in future repayments.