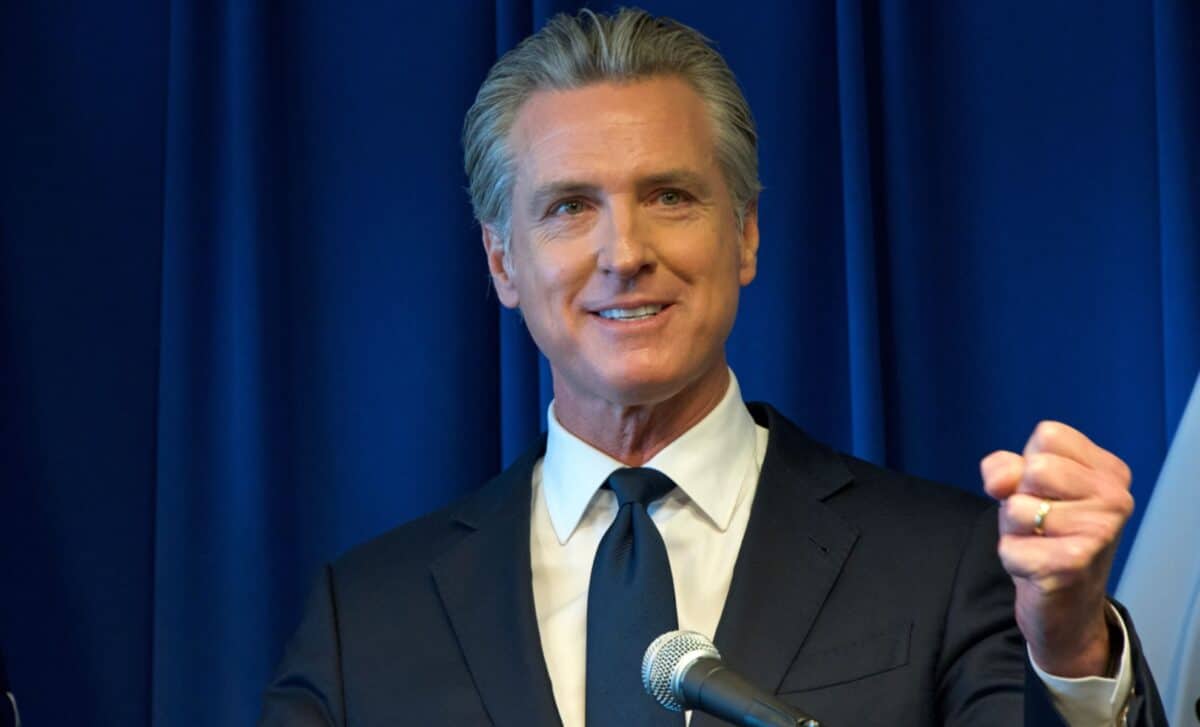

California has introduced a $20,000 state income tax exclusion for military retirees and certain surviving spouses, marking a significant policy shift in how the state treats military retirement income. The change arrives as Governor Gavin Newsom signed SB 694, legislation aimed at limiting predatory practices in the federal veterans’ benefits system.

The combined measures affect a large community. There are about 160,000 active-duty service members and nearly 1.5 million veterans living in California, according to the Governor’s office. The tax exclusion and new legal protections are part of a broader state effort to support veterans financially while tightening oversight of claims assistance services.

New $20,000 Tax Exclusion for Military Retirees and Surviving Families

For the first time, veterans receiving military retirement pay and families receiving payments from the federal Survivor Benefit Plan (SBP) may exclude up to $20,000 of that income each year from California state income taxes. According to Newsweek, this exclusion applies beginning with tax year 2025 under the 2025–2026 state budget.

California previously taxed all military retirement pay and SBP income. The new provision allows eligible retirees and surviving spouses filing in the state to reduce their taxable income by up to $20,000 annually. Financial literacy instructor Alex Beene told the same source that the measure forms part of “a greater push to support veterans financially while cracking down on fraud.”

The Governor’s office stated that the tax break is intended to help retain retired service members in California while strengthening local economies. Josh Fryday, California’s Chief Service Officer, said in a statement that, combined with the new consumer protections, the law is putting “real protections and real dollars back into the hands of those who sacrificed for our country,” according to the official release.

SB 694 Strengthens Oversight and Limits Unauthorized Fees

At the same time, Governor Newsom signed SB 694, introduced by State Senator Bob Archuleta, to address fraudulent and misleading practices in veterans’ benefits claims. According to the Governor’s announcement, the law requires federal accreditation before any person may prepare, present, or prosecute a veteran’s claim for benefits.

The legislation prohibits unauthorized fees except as expressly allowed under federal law and expands the California Consumer Legal Remedies Act to cover veterans’ benefits claims. It also bars the sharing of login credentials or requiring veterans to provide personal identification numbers associated with secure government systems.

Attorney General Rob Bonta described so-called “claim sharks” as posing a financial risk to veterans seeking assistance, stating that SB 694 will deter predatory individuals and companies from exploiting them, according to the Governor’s office. State Senator Sabrina Cervantes said the bill provides a framework to protect veterans from being defrauded when applying for benefits through the U.S. Department of Veterans Affairs.

California’s network of County Veteran Service Officers filed 316,000 claims in the 2024–2025 fiscal year, securing an estimated $687 million in new or increased federal benefits, according to the state. In the same period, they served nearly one million veterans and family members statewide.