Global stock markets experienced a sharp decline on April 4 following a new escalation in the ongoing trade war between the U.S. and China. In response to President Donald Trump’s latest tariff policies, China imposed additional tariffs on U.S. goods, deepening the economic uncertainty.

Reuters reports that this move has stirred fears of a potential recession, contributing to some of the largest market losses since the pandemic. Investors are now left grappling with the implications of this intensifying trade conflict and its impact on global financial stability.

The trade war intensifies

China’s move to raise tariffs is part of its retaliation against U.S. trade barriers, which were recently increased to their highest levels in over a century. In addition to the tariffs, China announced controls on the export of some rare earths, essential materials used in the technology sector.

This action, combined with the addition of 11 U.S. entities to China’s “unreliable entity” list, heightened tensions between the two economic superpowers, further impacting stock markets globally.

The Nasdaq Composite, a tech-heavy index, confirmed it had entered a bear market after a significant drop, marking a stark contrast to its record closing high of 20,173.89 on December 16.

Similarly, the Dow Jones Industrial Average saw a correction after reaching its record closing high of 45,014.04 on December 4. The market sell-off was severe, with the S&P 500 falling 9.08%, the Nasdaq declining by 10.02%, and the Dow down by 7.86%. The Russell 2000 Small Cap Index dropped 9.70%.

“This is significant and is unlikely to be over, hence the negative market reactions,”

Said Stephane Ekolo, Market & Equity Strategist at Tradition in London.

“Investors are afraid of a ‘tit for tat’ trade war situation.”

Global Economic Impact and Recession Fears

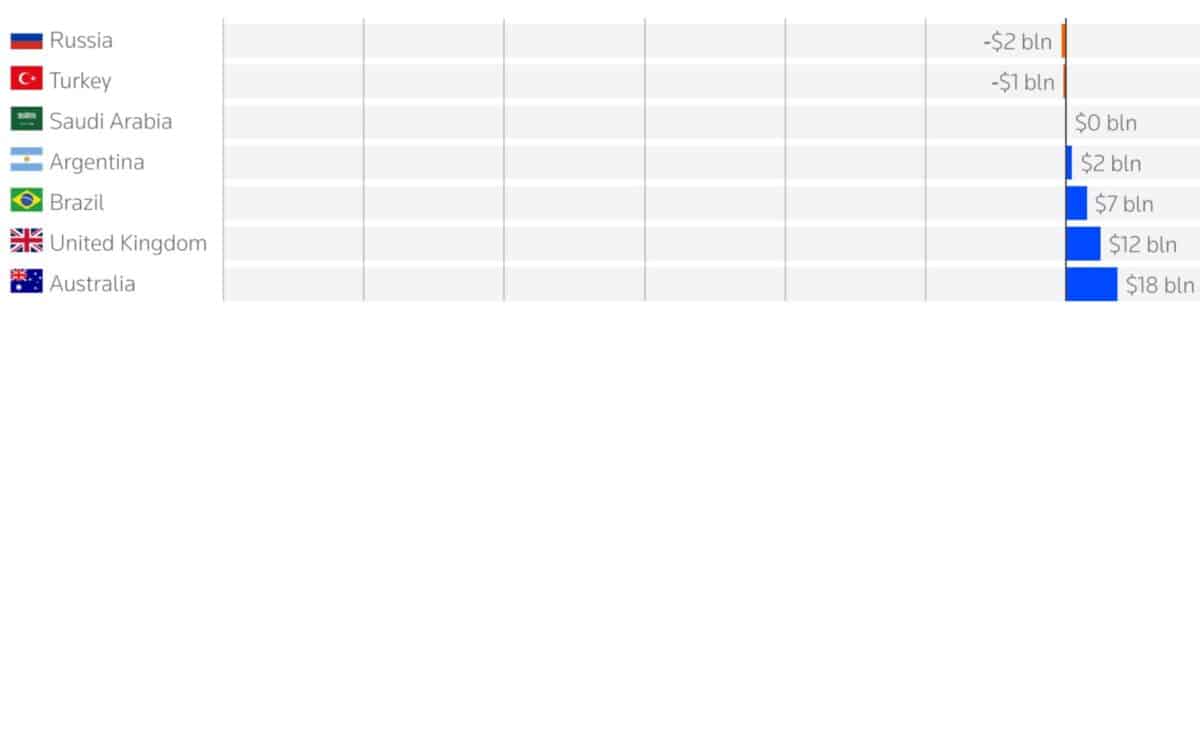

Investment bank J.P. Morgan has raised the likelihood of a global recession to 60% by the end of the year, up from 40% previously, due to the economic uncertainties surrounding the trade war.

The global stock market response to the U.S.-China standoff has been widespread, with Canada preparing retaliation against U.S. tariffs. Japan, one of the top U.S. trading partners, has also experienced a market downturn, with Prime Minister Shigeru Ishiba describing the tariffs as a “national crisis.”

In Europe, financial markets have seen significant losses, with the EU’s trade commissioner, Maros Sefcovic, describing U.S. tariffs as “damaging” and “unjustified.” Sefcovic wrote on social media:

I was clear: US tariffs are damaging, unjustified. The EU’s committed to meaningful negotiations but also prepared to defend our interests.

There is internal division within the EU on how best to respond, with some nations such as Ireland, Italy, and Poland cautious about retaliating and escalating the situation further.

Meanwhile, French President Emmanuel Macron has led efforts to freeze investments in the U.S., although French Finance Minister Eric Lombard later warned that retaliatory measures could backfire, increasing costs for European consumers.

Political and market reactions

Politicians, including U.S. Senator Ted Cruz, a staunch Trump supporter, have raised alarms about the potential risks of the tariffs on the U.S. economy and stock markets.

Cruz warned that the tariffs could result in “trillions of dollars of increased taxes on American consumers.” He expressed hope that Trump would use the tariffs as leverage to reduce other countries’ trade barriers, but cautioned that a prolonged trade war would be a “terrible outcome” for Americans.

President Trump, however, has remained defiant. While the market sell-off continued, Trump posted multiple social media messages from his golf course, assuring that the U.S. economy would ultimately benefit from his trade policies. In an all-caps post, Trump wrote,

To the many investors coming into the United States and investing massive amounts of money, my policies will never change. This is a great time to get rich, richer than ever before!!!

He also dismissed China’s retaliation, posting after Beijing’s actions :

China played it wrong, they panicked – the one thing they cannot afford to do!

Trump called it the “perfect time” for the Federal Reserve to cut interest rates, criticizing Fed Chair Jerome Powell with a message saying,

CUT INTEREST RATES, JEROME, AND STOP PLAYING POLITICS!

Meanwhile, Powell acknowledged the economic uncertainty during a press conference, stating,

People are just, they just are kind of waiting for clarity – adding,

I can’t tell you when that will pass, but you know, ultimately it will pass.

The EU’s Divided Response

The EU’s response to the tariffs has been mixed. While some countries within the EU, such as Ireland, Italy, Poland, and the Scandinavian nations, are hesitant to escalate the trade war, others, including France, have been more vocal in opposing the U.S. tariffs.

Macron’s push for companies to freeze investment in the U.S. has caused further divisions, with some warning that this could also hurt European consumers by raising prices for goods like cannabis, running shoes, and electronics.

Projections suggest that a high-end iPhone could cost up to $2,300 if these tariffs are passed on to consumers.