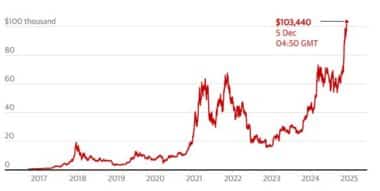

Bitcoin has just crossed the remarkable $100,000 mark for the first time in its history, a milestone that has sent shockwaves through the global financial landscape. This significant price surge is more than just a temporary market spike; it’s a signal that the cryptocurrency is becoming an undeniable force in the world of finance. As Bitcoin continues to climb, the reasons behind its rise have become clearer, with factors such as political shifts, growing institutional adoption, and clearer regulatory pathways playing crucial roles.

With Bitcoin’s recent ascent, crypto enthusiasts and investors alike are re-evaluating its place in the financial ecosystem. But what exactly is driving this surge? Let’s take a closer look at the forces behind Bitcoin’s price surge and what it could mean for the future of digital assets.

Institutional Adoption and the Road to Mainstream Acceptance

Bitcoin‘s price surge isn’t just driven by speculation; it’s supported by solid institutional backing and growing mainstream recognition. Mike Novogratz, founder and CEO of the US crypto firm Galaxy Digital, stated, “We’re witnessing a paradigm shift. After four years of political purgatory, bitcoin and the entire digital asset ecosystem are on the brink of entering the financial mainstream.” Novogratz’s words capture the current sentiment in the crypto world, as Bitcoin moves from a niche investment to a more widely accepted financial instrument.

A large part of this momentum comes from institutional adoption. Once seen as a volatile asset, Bitcoin is now regarded by many large institutions as a viable long-term store of value. As corporate interest in Bitcoin grows, this digital currency is rapidly gaining traction among investors who see it as a hedge against inflation and an alternative to traditional assets like gold.

Furthermore, the recent breakthroughs in tokenization and payment systems have contributed to Bitcoin’s mainstream appeal. Advances in blockchain technology and the growing acceptance of cryptocurrencies as legitimate assets are making it easier for both businesses and consumers to interact with Bitcoin.

Political Shifts and Regulatory Clarity: Boosting Investor Confidence

Political developments, particularly in the United States, have had a profound impact on the future of Bitcoin. The growing optimism surrounding Bitcoin is linked not only to its market value but also to the regulatory clarity coming from governments worldwide. Bitcoin’s rally coincides with speculation about how governments will treat cryptocurrencies in the future.

As Bitcoin advocates push for more supportive regulation, signs are emerging that policymakers may provide clearer frameworks that facilitate more widespread adoption. This is especially true with growing institutional interest in the space and the possibility of a more crypto-friendly regulatory environment under the incoming U.S. administration.

Novogratz also highlighted the importance of these advancements, noting, “This momentum is fueled by institutional adoption, advancements in tokenization and payments, and a clearer regulatory path.” Such regulatory clarity is likely to attract even more institutional capital, which could, in turn, propel Bitcoin’s value even further.

The Bitcoin $100,000 Milestone: A Sign of Shifting Geopolitical Tides

For many crypto analysts, Bitcoin’s rise to $100,000 is more than just a financial achievement—it’s a reflection of larger, global changes. The world of finance is evolving, and Bitcoin is increasingly being recognized as a key player in this transformation. Justin d’Anethan, a Hong Kong-based independent crypto analyst, explained, “Bitcoin crossing $100,000 is more than just a milestone; it’s a testament to shifting tides in finance, technology and geopolitics.”

The recognition of Bitcoin’s importance is growing not just in financial markets but in geopolitical circles as well. As more countries look to digital currencies for economic stability, Bitcoin’s role on the world stage is becoming more pronounced. Countries with unstable currencies are beginning to see the benefits of adopting Bitcoin as an alternative store of value, which is only adding to its appeal.

The New Reality: Bitcoin as a Mainstream Asset

Once dismissed as a fantasy by many, Bitcoin’s rise to $100,000 is now seen as a reality. “The figure not that long ago dismissed as fantasy stands as a reality,” says d’Anethan. What was once considered an unrealistic dream has become an undeniable truth, and Bitcoin’s increasing value demonstrates how far the cryptocurrency market has come in a short period of time.

The $100,000 mark signifies not just a price point but a broader shift in how the world views digital currencies. For many, Bitcoin is no longer just a speculative asset but a legitimate part of the global financial system. This shift could have lasting effects on everything from banking to payments to international trade, as Bitcoin continues to gain traction in both traditional and alternative financial sectors.

Looking Ahead: Bitcoin’s Potential to Redefine the Future of Money

Despite its volatility, Bitcoin’s rise above $100,000 signals that the cryptocurrency is not just a passing trend. Its place in the global financial system seems secure as more people and institutions turn to Bitcoin as both an investment and a tool for financial transactions. As Novogratz puts it, Bitcoin is entering a new era of financial mainstream acceptance, and its future seems more promising than ever.

The road ahead for Bitcoin may not be without challenges, particularly with regulatory and technological hurdles still looming. However, with its increasing adoption, growing institutional backing, and evolving political and economic factors, Bitcoin is well-positioned to continue reshaping the future of money.